Understanding IRS Form 1120 Schedule L

Schedule L is a key component of IRS Form 1120, the annual tax form corporations file with the IRS. It gives the IRS a clear view of a corporation’s financial health by detailing its assets, liabilities, and shareholder equity, providing a financial snapshot of the company.

Filing Schedule L accurately and on time is essential for complying with IRS regulations and helps corporations monitor their financial stability.

Schedule L, or “Balance Sheets per Books,” requires corporations to report their balance sheet data exactly as it appears in their records. This section follows standard accounting principles, meaning the information provided reflects the company’s actual financial standing, not just numbers generated for the tax return.

Schedule L is a useful tool for keeping accurate financial records that meet IRS requirements and give a clear picture of a company’s financial health.

What Is The Purpose of the Form 1120 Schedule L

A corporation’s balance sheet offers a clear snapshot of its financial health by listing everything it owns (assets), what it owes (liabilities), and the remaining value shareholders hold (equity).

This breakdown, which appears on Schedule L of IRS Form 1120, captures the company’s financial position at the start and end of the tax year.

Completing Schedule L helps corporations make sure their tax filings reflect their actual finances and gives them a clear overview of their assets, liabilities, and shareholder investments.

For the IRS, Schedule L verifies that reported income and deductions reflect reality. Whether the company follows cash or accrual accounting can impact the numbers, but the goal remains the same: to offer a reliable and organized look at the corporation’s financial standing that benefits both tax compliance and financial planning.

Keep in mind, that it’s best to complete Schedule L (Balance Sheet) before Schedule M-1 (Reconciliation of Income (Loss) per Books With Income per Return) or Schedule M-2 (Analysis of Unappropriated Retained Earnings per Books (Schedule L, Line 25), as items on these schedules reconcile with the balance sheet.

Who Has To Complete Schedule L

For most C corporations, filing Schedule L with Form 1120 is necessary when their total assets exceed $10 million. This requirement, however, doesn’t apply to S corporations or partnerships.

There are some exceptions to the asset threshold:

- Newly formed corporations must file Schedule L on their first tax return, regardless of asset size.

- Foreign corporations with U.S. operations are required to file it as well.

This ensures the IRS gets a complete financial picture, even for companies that are new or based outside the U.S.

Smaller corporations have a bit more flexibility when it comes to filing requirements. Those with total receipts and year-end assets under $250,000 are generally exempt from filing Schedule L, provided they meet certain requirements and indicate this on Schedule K. This exemption helps smaller companies avoid preparing a detailed balance sheet and additional forms if their finances are below the set threshold.

Additional requirements kick in for larger corporations with $10 million or more in assets. These companies need to file Schedule M-3 instead of M-1, with specific instructions that also impact Schedule L. Corporations required to submit a balance sheet must ensure it aligns with the other data in their tax return.

Schedule L Instructions

We strongly recommend working with an experienced tax preparer for personalized advice on filling out Schedule L, which is just one part of the corporate income tax return, Form 1120. While Form 1120 is due April 15, it can be extended until Oct. 15 by filing Form 7004.

You can also visit our C-Corporation tax deadlines calendar to see the current year deadlines.

Here are high-level instructions on filling out Schedule L.

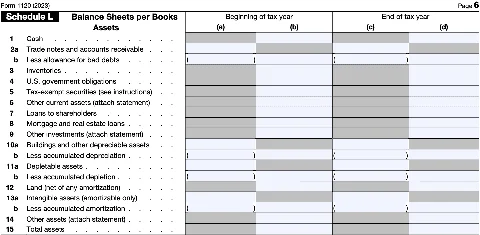

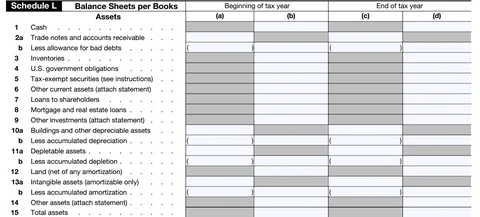

Step 1: Assets

The Assets section of Schedule L is where all corporate assets are either entered directly or pulled from other sections. This allows users to record each type of asset, providing a detailed breakdown to ensure accurate reporting on the Balance Sheet in Schedule L.

The section includes items such as cash, accounts receivable, inventories, and investments, among others, along with supporting details and adjustments.

- Cash: The beginning and ending balances of all cash accounts in Column (b) and Column (d).

- Trade notes and accounts receivable: Unpaid amounts due from clients; requires details for accrual-based reporting.

- Less allowance for bad debts: Adjustments for uncollectible accounts receivable.

- Inventories: This number is pulled from Form 1125-A, adjustments affect both the Schedule L and Form 1125-A.

- U.S. government obligations: Any treasury notes or U.S. bonds owned by the corporation.

- Tax-exempt securities: Includes tax-exempt investments like municipal bonds.

- Other current assets: Additional current assets, itemized separately.

- Loans to shareholders: Balances of loans to shareholders or relatives.

- Mortgage and real estate loans: Mortgage or real estate loans to third parties.

- Other investments: Additional investments not listed above, itemized separately.

- Buildings and other depreciable assets: The beginning cost or original basis for any buildings or depreciable property (like vehicles and machinery) used in the corporation’s business, unless it’s automatically pulled from last year’s return.

- Less accumulated depreciation: Total depreciation for assets, aligned with Form 4562.

- Depletable assets: Beginning and ending balances of assets subject to depletion.

- Less accumulated depletion: Depreciation for depletable assets.

- Land (net of any amortization): Corporate-owned land.

- Intangible assets (amortizable only): Assets subject to amortization, pulled from other tax sections.

- Less accumulated amortization: Total amortization for intangible assets.

- Other assets: Miscellaneous assets not covered in previous categories.

- Total assets: Sum of all entries in the Assets section of Schedule L.

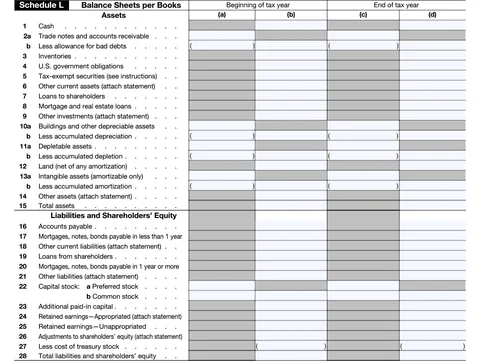

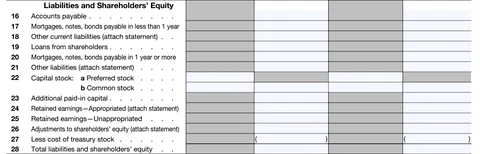

Step 2: Liabilities and Shareholders’ Equity

The Liabilities and Shareholders’ Equity section of Schedule L is where all corporate liabilities and shareholder equity accounts are recorded. While only beginning balances pull automatically from the previous year’s return, each item requires entry for accurate financial reporting on Schedule L.

This section includes details on accounts payable, loans, capital stock, retained earnings, and adjustments, among other items, providing a comprehensive view of the corporation’s liabilities and equity.

- Accounts payable: Amount owed to vendors for purchases on credit.

- Mortgages, notes, bonds payable in less than 1 year: Balances on loans due within the next 12 months.

- Other current liabilities: Itemize any liabilities due within the year not listed above, on Line 18, with an attached supporting statement.

- Loans from shareholders: Balances on loans from shareholders or relatives, with optional supporting details.

- Mortgages, notes, bonds payable in 1 year or more: Balances on loans due beyond the next 12 months.

- Other liabilities: Itemize any long-term liabilities not previously listed, with a supporting statement.

- Capital stock: Total book value of issued common and preferred stock, based on par value.

- Additional paid-in capital: Additional shareholder contributions above par value.

- Retained earnings—Appropriated: Accumulated, undistributed earnings, adjusted from Schedule M-2.

- Retained earnings—Unappropriated: Any adjustments needed to line 24. Generally, these adjustments should be made on M-2 if possible, rather than on line 25.

- Adjustments to shareholders’ equity: Itemize any equity adjustments not covered in Schedule M-2, for example, unrealized gains or foreign currency adjustments.

- Less cost of treasury stock: Value of repurchased stock, reducing total equity.

- Total liabilities and shareholders’ equity: The calculated total of all entries in the Liabilities and Equity section. This should match the Total Assets on Line 15.

Take full advantage of tax benefits for your startup

If you need help with startup tax planning, including general business credits, Form 1120, and whether you need to file a tax return at all, reach out to Kruze Consulting for help. We are experts at tax credits for startups.