What Does a Startup Need to Know about IRS 1099 Forms?

1099s are an IRS form that you’ve got to get out to your contractors by January 31st for work that they performed the prior year.

Form 1099-NEC and Form 1099-MISC

If your startup’s independent contractors received Form 1099-MISC in the past, they will now receive Form 1099-NEC. Use Form 1099-NEC to report payments to contractors for work done in 2020 and onwards. Before 2020, your contractors would have received Form 1099-MISC for independent contractor payments. However, the IRS introduced the 1099-NEC specifically to streamline reporting non-employee compensation.

The 1099-MISC form is still used, but for reporting other miscellaneous income that isn’t considered non-employee compensation. This can include things like rent payments or prizes.

How do you fill out a 1099?

We recommend using Track1099, a user-friendly, online software that simplifies the process of creating 1099 forms for your business. Here is now to use it to create 1099’s:

Getting Started with Track1099

To start using Track1099, you need an invite from Kruze or your accounting firm. This will allow you to set up your login. After this, we can assign your company file on the W-9 side. When you log in, you’ll see your company name. Click it to access request forms such as W-9 (for US-based contractors), W-8BEN (for international sole proprietors), and W-8BEN-E (for international entities).

Of course, you can also just go to their website and set up an account if you are not a Kruze client!!

Requesting W-9

You can request a W-9 form by simply entering the name and email address of the contractor. Alternatively, you can bulk request by downloading a W-9 CSV template, filling in the names and emails, and importing it into the system. This is recommended if you have a bunch of contractors!

After sending the request, the status will indicate “Requested”. Once the contractor submits their W-9 form, it changes to “Signed”. However, be sure to warn your contractors that Track1099 emails, while secure, can sometimes be mistaken for phishing.

Creating a 1099

To create a 1099 form, add the contractor’s details ensuring to have a valid email address. If the details are incorrect, the status will indicate “Bounced”.

If a contractor sends you a PDF form, you can manually add the form to the system. Just copy over the information exactly as it is on the form. It’s crucial to ensure it matches their tax return to avoid any complications.

Once you add the contractor’s details manually, you can delete any previous requested form.

Adding a Company

To add a company, Track1099 requires an email address and Employer Identification Number (EIN). E-filing is the primary method, but Track1099 also offers e-delivery and mailing options. However, e-delivery is preferable as it allows tracking of sent and opened forms.

Track1099 acknowledges that C Corps usually don’t need a 1099 form. You can manually select these exceptions and they will be synced to the 1099 side when needed.

Adding International Forms

The process of adding international forms is the same as domestic ones. Use the W-8BEN and W-8BEN-E forms for international contractors and make sure to have all the information on the form.

If you encounter any issues or have any questions, feel free to reach out. We’re always here to assist.

And you can visit our “how to use track1099” page to get more detailed instructions on how to fill out, create and send 1099’s.

Who Should Get A 1099?

Contractors, LLCs, landlords, and often law firms - people or entities your company pays who are not 1) employees or 2) C-corporations. Secondly, only people who were paid $600 or more, in aggregate, the previous year.

You should request W-9s from all of your non-employee vendors. Some vendors will let you know that they are C-corps and therefore do not get a 1099, so they won’t fill out a W-9.

What Is A W-9 Form?

The IRS W-9 form, or “Request for Taxpayer Identification Number and Certification,” is a document that freelancers, contractors, and non-employee vendors fill out to provide their taxpayer identification number (TIN) to businesses paying them for their work. It’s often filled out when starting contract work and helps businesses prepare accurate 1099 tax forms, which report yearly payments to non-employees. By filling out a W-9, contractors confirm their tax ID (like an SSN or EIN) and certify they’re not subject to backup withholding.

This form has two main sections: one for personal details like name, address, and TIN, and another for a signature certifying the accuracy of the information.

How To Read 1099 Forms

Forms 1099-MISC and 1099-NEC are IRS forms that report income types outside of standard wages or salaries. If you’ve earned income as an independent contractor or freelancer, you may receive one or both of these forms depending on the payments you received.

Typically, Form 1099-NEC reports nonemployee compensation over $600, which is common for freelancers and self-employed individuals, while Form 1099-MISC covers other income like rent, prizes, or legal settlements.

With a variety of IRS forms, it can be hard to keep them all straight. The 1099 forms focus specifically on income sources outside of traditional employment, unlike a W-2, which only reports wage and salary income.

Each type of Form 1099 is used for a particular income source, like dividends, retirement distributions, or interest income. Here are some of the most common Forms 1099 you might see during tax season:

- Form 1099-B: Proceeds from Broker and Barter Exchange Transactions

- Form 1099-DIV: Dividends and Distributions

- Form 1099-INT: Interest Income

- Form 1099-R: Distributions from Retirement Plans, IRAs, and Annuities

- Form 1099-MISC: Miscellaneous Information (e.g., rent, prizes)

- Form 1099-NEC: Nonemployee Compensation

- Form 1099-K: Payment Card and Third-Party Network Transactions

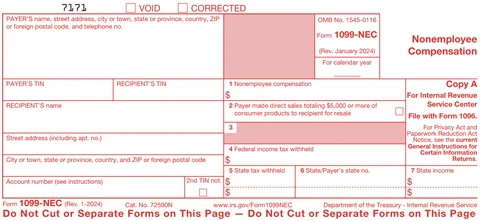

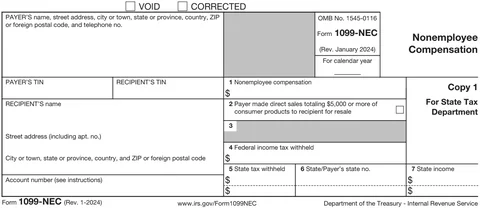

Understanding Your 1099-NEC Form

Form 1099-NEC is used by companies to report non-employee compensation of $600 or more paid to independent contractors and freelancers throughout the year. This includes payments like fees, commissions, and other earnings for contract-based work. By reporting these amounts, the IRS can track income not reported through traditional employment.

Here’s a look at the main sections on Form 1099-NEC:

- Box 1: Non-employee compensation of $600 or more

- Box 2: Checkbox for direct sales of $5,000+ to the recipient for resale

- Box 4: Federal income tax withheld (usually blank for contractors)

- Boxes 5-7: State-specific tax details

Understanding Your 1099-MISC Form

Form 1099-MISC form is used by businesses to report various types of income outside regular wages, such as rental income, royalties, and certain medical payments. Companies file this form for payments over $600 for rent, healthcare, or miscellaneous services and royalties of $10 or more. This form helps the IRS track these types of payments, ensuring recipients report all taxable income accurately.

Each box on the 1099-MISC covers a specific type of payment. There are also boxes for unique items like fishing proceeds, crop insurance payouts, and state-specific tax details.

Here’s a look at the main sections on Form 1099-MISC:

- Box 1: Rents paid of $600 or more

- Box 2: Royalties paid of $10 or more

- Box 3: Prizes, awards, and other non-wage payments

- Box 4: Federal income tax withheld (often left blank)

- Box 6: Medical and healthcare payments over $600

- Box 7: Sales of consumer goods totaling $5,000+ for resale

- Box 10: Attorney fees of $600 or more

- Box 13: FATCA filing requirement indicator

- Boxes 16-18: State-specific tax details

Guide To Filling Out Form 1099

You can e-file Form 1099 or you can download a PDF that you can fill out, print, and then paper file.

Here are high-level instructions on how to fill out Form 1099.

Step 1: Fill Out Form 1099-NEC

To fill out a 1099-NEC form, start by entering essential information about your business and the contractor. In Box 1, list the total nonemployee compensation paid to the contractor, which is the main focus of this form. In the top section, include your business’s taxpayer identification number (TIN), name, and address as the payer’s information. For the contractor, provide their TIN, name, and address in the designated areas.

Box 4 is for any federal income tax withheld, though this will typically be blank since contractors usually handle their tax withholdings. There’s also an optional section to add state income details and your state tax ID, which isn’t required by the IRS but can make state tax filings simpler for the contractor.

Here’s a quick guide to the key parts of the 1099-NEC:

- Box 1: Total nonemployee compensation paid to the contractor

- Payer’s TIN: Your business’s taxpayer identification number

- Payer’s information: Your company’s name and address

- Recipient’s TIN: Contractor’s taxpayer identification number

- Recipient’s name and address: Contractor’s full name and address

- Box 4: Federal income tax withheld (if any)

- State section: Optional state income details and tax ID

Step 2: File Copy A With The IRS

Once you’ve filled out Form 1099, you will need to submit Copy A to the IRS.

If you’re filing by mail, note that you can’t print Copy A from the IRS website to submit. Instead, you’ll need to get an official 1099-NEC form from the IRS or an authorized provider, fill out Copy A, and send it by mail.

Many states also require businesses to submit Copy 1 to the state’s Department of Revenue to ensure state tax authorities receive the necessary information.

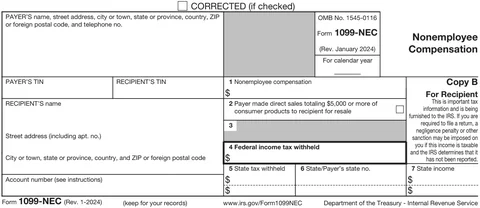

Step 3: Send Copy B To The Independent Contractor

You will also need to send Copy B to your independent contractor by January 31. This copy helps contractors file their taxes accurately by detailing the income they earned from your business.

You can download and print Copy B from the IRS website, making it easy to provide contractors with the necessary information.

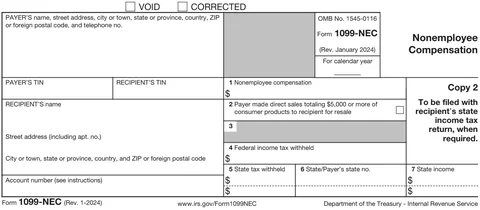

Step 4: Retain Copy C For Your Records

Businesses should keep Copy C of Form 1099-NEC for their records. This copy serves as documentation of wage expenses paid to contractors, which is important for accurately reporting these expenses on the company’s tax return.

Having Copy C on hand makes it easy to track payments made throughout the year and helps simplify the tax filing process.

How to get Form 1099 help

If you need help with Form 1099, startup tax planning, including general business credits, Form 1120, and whether you need to file a tax return at all, reach out to Kruze Consulting for help. We are experts at tax credits for startups.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1099 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1099 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1099 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Instructions for Recipient

You received this form instead of Form W-2 because the payer did not consider you an employee and did not withhold income tax or social security and Medicare tax. If you believe you are an employee and cannot get the payer to correct this form, report the amount shown in box 1 on the line for “Wages, salaries, tips, etc.” of Form 1040, 1040-SR, or 1040-NR. You must also complete Form 8919 and attach it to your return. For more information, see Pub. 1779, Independent Contractor or Employee.

If you are not an employee but the amount in box 1 is not self- employment (SE) income (for example, it is income from a sporadic activity or a hobby), report the amount shown in box 1 on the “Other income” line (on Schedule 1 (Form 1040)). Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your TIN (social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN)). However, the issuer has reported your complete TIN to the IRS. Account number. May show an account or other unique number the payer assigned to distinguish your account.

Box 1. Shows nonemployee compensation. If the amount in this box is SE income, report it on Schedule C or F (Form 1040) if a sole proprietor, or on Form 1065 and Schedule K-1 (Form 1065) if a partnership, and the recipient/partner completes Schedule SE (Form 1040).

Note: If you are receiving payments on which no income, social security, and Medicare taxes are withheld, you should make estimated tax payments. See Form 1040-ES (or Form 1040-ES (NR)). Individuals must report these amounts as explained in these box 1 instructions. Corporations, fiduciaries, and partnerships must report these amounts on the appropriate line of their tax returns.

Box 2. If checked, consumer products totaling $5,000 or more were sold to you for resale, on a buy-sell, a deposit-commission, or other basis. Generally, report any income from your sale of these products on Schedule C (Form 1040).

Box 3. Reserved for future use.

Box 4. Shows backup withholding. A payer must backup withhold on certain payments if you did not give your TIN to the payer. See Form W-9, Request for Taxpayer Identification Number and Certification, for information on backup withholding. Include this amount on your income tax return as tax withheld.

Boxes 5–7. State income tax withheld reporting boxes. Future developments. For the latest information about developments related to Form 1099-NEC and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form1099NEC. Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost online federal tax preparation, e-filing, and direct deposit or payment options.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1099 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1099 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.