The R&D tax credit is a great way for startups to save money on their taxes. The credit lets companies that conduct research and development reduce their income taxes. But what about startups that aren’t making a profit? In 2015, the R&D tax credit was expanded to allow startups to use their R&D tax credits to offset their payroll tax liabilities – which means even unprofitable companies can claim the credit and reduce their burn rate. Use our R&D calculator to find out how much you might save by claiming the incentive.

The R&D tax credit is a federal incentive that encourages companies to invest in research and development by providing a dollar-for-dollar reduction in a company’s tax liability. Activities that qualify for the R&D tax credit include developing or designing new products, enhancing existing products or processes, and developing or improving existing prototypes and software. To claim it, you’ll need to rigorously document these activities, including payroll expenses; receipts for supplies and equipment; contracts and invoices related to the research; blueprints, patents, designs, and prototypes; and even project meeting notes. The process is complex, so consult a CPA that’s an R&D tax credit expert, like Kruze Consulting, to make sure you collect everything you need.

Submitting the claim – Form 6765

Your accountant will complete IRS Form 6765, that needs to be filed as part of your IRS Form 1120 package, the US Corporation Income Tax Return. This is the corporate tax return your startup files on April 15 of each year (due to holidays the tax filing date in 2023 was shifted to April 18, which can be extended to October 16).

That sounds great. But if your startup qualifies, how do you get the money?

It starts with income taxes – the first place the claim hits

First and foremost, the R&D tax credit is used to offset any income tax liabilities. But startups. don’t usually have revenue coming in, or certainly not enough revenue that’s going to put them in a liability position. Startups that have been around for a little bit longer may have revenue coming in. In those cases any income tax liabilities are covered first with the R&D tax credit. This means that your company’s annual tax bill will go down – pretty easy to understand; this is how many IRS led incentives work. But what if your startup isn’t profitable? Well, companies also pay payroll taxes – even unprofitable ones. This is the next place the startups can claim and get a reduction in what they pay the government. Read on to learn more:

Startups that are Qualified Small Businesses (QSBs) – payroll taxes, the next place to claim a reduction

Qualified small businesses are companies that:

- have less than $5 million in revenue for the prior tax year

- have not claimed the R&D tax credit for more than five years

- don’t have gross receipts in the fifth preceding tax year (for example, in 2022 the fifth preceding tax year was 2018)

QSBs can choose to receive the R&D tax credit as a payroll tax refund. That means those companies will file Form 8974 and submit that to the payroll provider. This allows them to get a refund for their Federal Insurance Contributions Act (FICA) Social Security tax (currently 6.2%) as well as the Medicare taxes (currently 1.45%). This starts in the quarter following the filing of the return. So companies that file in Q3 are eligible to start receiving this refund in Q4.

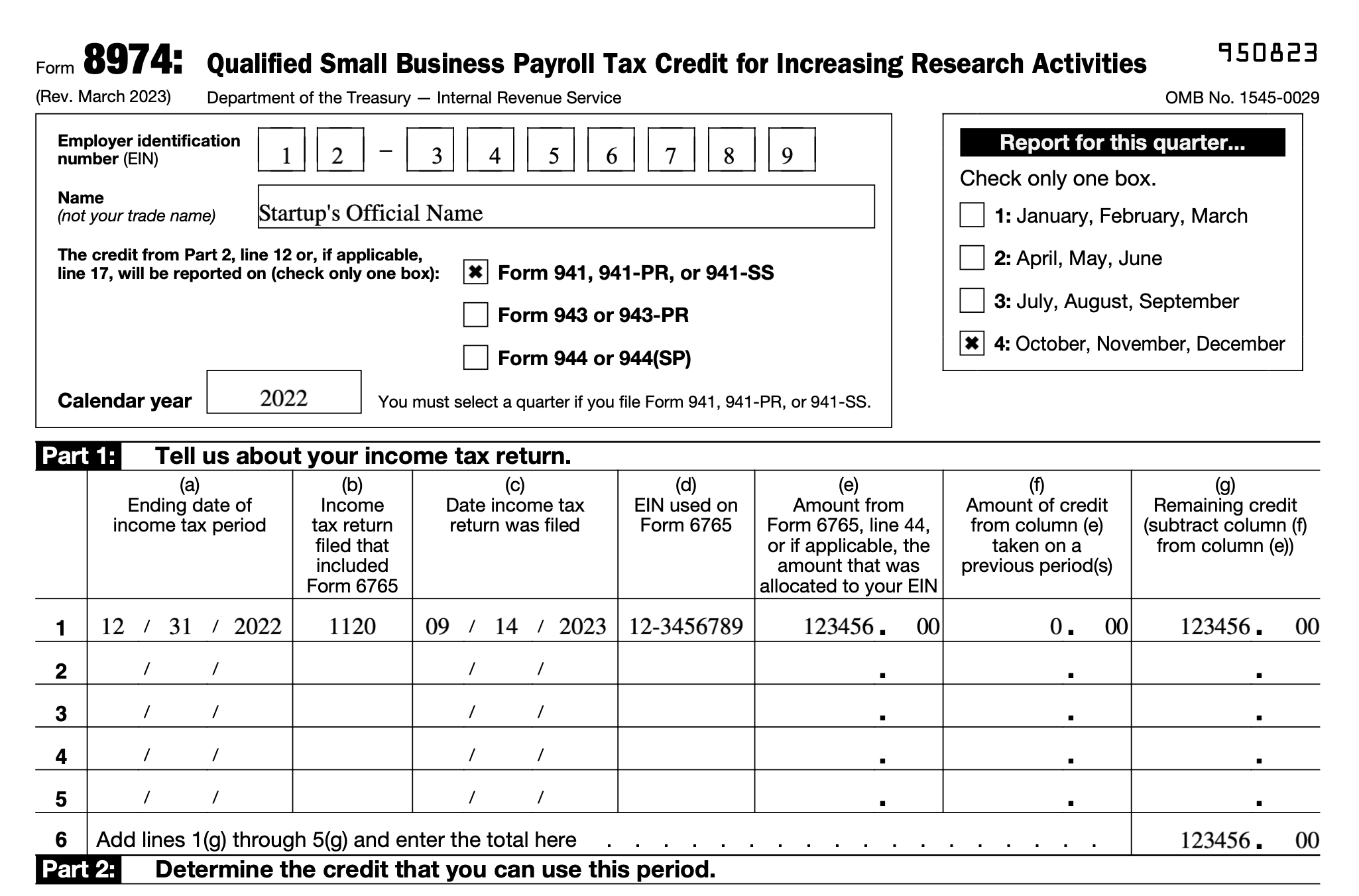

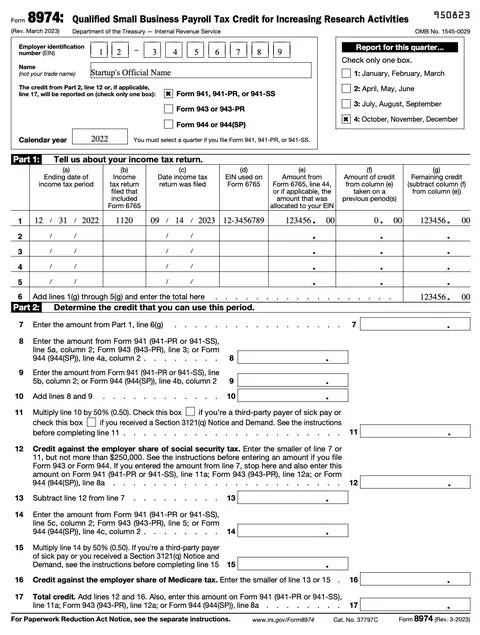

More Paperwork to get the claim – Form 8974

The illustration is an example of IRS Form 8974, which is submitted to the payroll providers. The form includes the startup’s name along with their Employer Identification Number (EIN). The calendar year and appropriate quarter are noted on the form, and in Part 1, the payroll tax credit amount is entered. This form is submitted by the payroll provider to the IRS every quarter until the entire amount of the incentive has been utilized.

Importantly, there is no lump sum payment option available. The IRS is very, very firm about this. This is only able to be refunded in the form of credits for the payroll tax that the QSBs pay.

Gusto credit options for QSB

Gusto is currently the only payroll provider that offers its clients the option to receive a real-time credit option. With this, QSBs that are Gusto clients simply don’t have to pay the FICA Social Security tax and the Medicare tax, up to the amount of the credit that’s been identified for them. This is a great way for QSBs to receive that credit much more quickly, because otherwise they’re looking at quite a substantial delay. The 8974 forms aren’t filed by the payroll providers until the start of the following quarter, and then it can take months for the IRS to return these funds, either in the form of a statement credit or a paper check. Note that there is one little slug of the incentive that Gusto doesn’t provide this service for, which means that Gusto clients will still get a small check from the IRS.

What about startups that aren’t QSBs – can they claim the credit?

Startups that aren’t QSBs, because they’ve been around too long, have too much revenue, and have claimed the incentive too many times, can still claim it. They’re able to use it to offset future tax liabilities with a 20-year carry-forward limit. They don’t file Form 8974, because they’re not eligible to receive the payroll tax credit.

You should partner with an experienced and knowledgeable CPA to:

- Make sure you’re eligible for the credit.

- Determine what documents you need to document your R&D expenditures.

- Complete IRS Form 6765 to submit with your annual return.

- Complete IRS Form 8974 to submit quarterly to your payroll provider.

You’ll also need to monitor your payroll provider to make sure you get your payout every quarter – we’ve seen payroll providers make mistakes, and that could cost your startup money! Visit our R&D tax credit page for a complete rundown on claiming the research and development tax credit. And if you have other questions, please contact us.

One other item to note - the R&D tax credit has one definition of QSBS, whereas there is another popular tax incentive called the Qualified Small Business Stock tax incentive. These are note the same definition (come on IRS!) but the Qualified Small Business Stock tax incentive enables investors in C-Corps, that meet specific small business qualifications, to avoid or dramatically reduce their federal capital gains taxes. You can read more about QSBS in our article on the topic.