Understanding IRS Form 1125-E

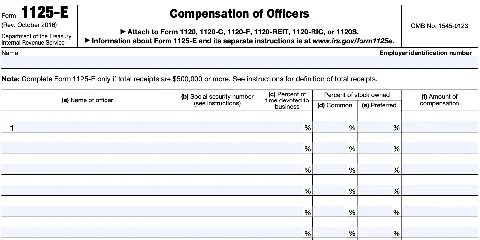

IRS Form 1125-E, titled “Compensation of Officers,” is used by corporations to report the compensation paid to their officers. This form is necessary for S-Corporations (S-corps) or C-Corporations (C-corps) with total gross receipts of $500,000 or more during the tax year.

State laws typically determine who qualifies as an officer, and the form must be submitted to the Internal Revenue Service (IRS) as part of the corporation’s annual filing process. Form 1125-E is typically attached to other IRS forms, such as Form 1120, when the entity claims a deduction for officer compensation.

Who Has To Complete Form 1125-E?

Corporations need to file Form 1125-E if they have total receipts of $500,000 or more and claim deductions for officer compensation. This form must be attached to other IRS forms like 1120, 1120-C, 1120-F, 1120-RIC, 1120-REIT, or 1120-S as part of the annual tax filing process.

Form 1125-E collects detailed information about the officers, including their names, titles, and total compensation. It helps promote transparency in reporting the corporation’s executive compensation structure and ensures accurate financial disclosure, keeping corporate financials clear and compliant with IRS rules.

How To Determine Total Receipts

When filing Form 1125-E, corporations need to calculate their total receipts accurately. The process varies depending on the type of form being used. Here’s how corporations can determine total receipts for different forms:

- Form 1120: Add line 1a to lines 4 through 10 on page 1.

- Form 1120-C: Combine line 1a with lines 4 through 9 on page 1.

- Form 1120-F: Sum line 1a with lines 4 through 10 in Section II.

- Form 1120-RIC: Include Part I, line 8, plus net capital gain from Part II, line 1, and Form 2438, line 9a.

- Form 1120-REIT: Add Part I, line 8, and net capital gain from Part III, line 10, plus Form 2438, line 9a.

- Form 1120S: Add line 1a, lines 4 and 5 on page 1, and include income or net gains from Schedule K lines 3a, 4, 5a, 6, 7, 8a, 9, and 10, as well as Form 8825, lines 2, 19, and 20a.

Who Qualifies As An ‘Officer’ For Form 1125-E Reporting?

The corporation determines who qualifies as an officer based on the laws of the state or country in which it is incorporated.

For example, California law outlines that an officer is someone appointed or designated by the corporation’s articles of incorporation, bylaws, or relevant laws. An officer can also be someone performing typical officer duties.

Corporations in California are generally required to have a chairperson or president, a secretary, and a treasurer or chief financial officer. However, corporations can include additional officers as necessary, as defined by their bylaws or determined by the board.

Officers are usually chosen by the board and serve at its discretion unless otherwise specified in the corporation’s foundational documents. This flexibility allows corporations to adapt their leadership structures while ensuring compliance with state laws.

In Delaware, however, the roles and titles of corporate officers are usually detailed in the company’s bylaws but don’t need to be listed on the Certificate of Incorporation. Officers are appointed by the Board of Directors and are in charge of turning the board’s vision into action, as well as driving the company’s goals forward.

Delaware offers flexibility in who can serve as a corporation officer. Nearly anyone, except individuals from U.S. Treasury-restricted countries (e.g., Cuba, Iran, North Korea, Syria), can take on these roles and manage the company from anywhere in the world.

The most common officer positions include the CEO or President, who oversees company activities and signs major contracts; the Secretary, who keeps corporate records and minutes; and the Treasurer or CFO, who handles financial reporting.

Unlike other states, Delaware doesn’t require specific officer roles, so one person can manage an entire corporation. For new startups, it’s common for the founder to initially be the only officer, director, and shareholder, with the officer structure expanding as the company grows.

What Goes On Form 1125-E?

Form 1125-E includes detailed information for each corporate officer, including their name, Social Security number, ownership percentage, time spent on business activities, and total compensation.

What Compensation Must Be Reported?

When filling out Form 1125-E, corporations must report the total deductible compensation for each officer, which includes the following:

- Salaries

- Commissions

- Bonuses

- Taxable fringe benefits

For S-Corps, fringe benefits for officers who own more than 2% of the company’s stock should be included, while those for officers owning 2% or less should be reported separately on the tax return.

Golden parachute payments, which are large payouts to key personnel if a company changes control, may not be fully deductible if they exceed an officer’s regular compensation. These special agreements fall under section 280G regulations.

Publicly traded companies also face limits on deducting compensation over $1 million for “covered employees,” including top executives and the three highest-paid officers. This restriction doesn’t include income from employee trusts, pensions, or annuity plans that are excluded from taxable income.

When is Form 1125-E Due?

Form 1125-E must be submitted along with the main tax form it’s filed with. For forms filed with 1120-S, the due date is March 15, while those filed with Form 1120 are due on April 15.

Form 1125-E Instructions

When filing Form 1125-E, we strongly recommend working with an experienced tax preparer to ensure accurate reporting and compliance with IRS regulations, avoiding costly errors and penalties.

Here are high-level instructions for filling out Form 1125-E.

Step 1: Line 1

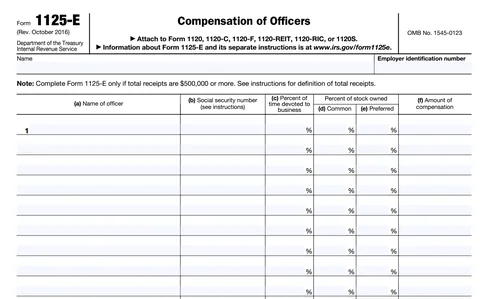

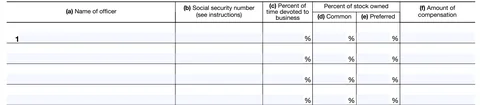

When filling out Form 1125-E, corporations must complete columns (a) through (f) for each officer based on the laws where the corporation is incorporated. If a consolidated return is being filed, details for each officer in the affiliated group must be included, but the parent company can file one Form 1125-E for the group. Here’s what to know for specific columns:

- Column (a): Provide the name of each officer.

- Column (b): Provide each officer’s Social Security number (SSN). To protect privacy, filers can choose to include only the last four digits.

- Column (c): Provide a percentage of time each officer devoted to the business.

- Column (d): Provide the percentage of “Common” stock owned by each officer.

- Column (e): Provide the percentage of “Preferred” stock owned by each officer. If no preferred stock has been issued, this column should be left blank.

- Column (f): Enter the total deductible compensation for each officer, which includes salaries, commissions, bonuses, and taxable fringe benefits. For S corporations, include fringe benefits and expenses for officers owning more than 2% of the stock, while those for officers owning 2% or less should be reported elsewhere. Refer to Form 1120S instructions for more details on officer compensation reporting.

Step 2: Line 2

On Line 2 of Form 1125-E, you will sum up the compensation for each officer listed on the form.

Step 3: Line 3

For Line 3 on Form 1125-E, corporations should include any officer compensation allocated to labor costs that are part of the cost of goods sold (COGS) on Form 1125-A. This ensures that all officer-related labor expenses within COGS are accurately reported.

When filling out Form 1125-E, corporations should include officer compensation that has already been deducted in other areas of the tax return, such as costs included in the cost of goods sold or contributions to 401(k) or SIMPLE IRA plans.

If the company is claiming tax credits for wages, it may need to adjust the deductible officer compensation to comply with section 280C. Additionally, any taxable fringe benefits provided to officers, like personal car use, should not be deducted as wages if related expenses, such as depreciation, are already claimed elsewhere on the return.

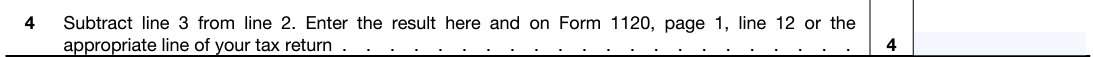

Step 4: Line 4

On Line 4 of Form 1125-E, subtract Line 3 from Line 2 and enter the result on the relevant line of the main tax return, Form 1120, page 1, line 12.

Conclusion

If you need help with startup tax planning, including Form 1125-E, and Form 1120, or whether you need to file a tax return at all, reach out to Kruze Consulting for help. We are experts at tax credits for startups.

Form 1125-E (Rev. October 2016) Department of the Treasury Internal Revenue Service

| (a) Name of officer | (b) Social security number (see instructions) |

(c) Percent of time devoted to business |

Percent of stock owned | (f) Amount of compensation |

|

| (d) Common | (e) Preferred | ||||

|

1

|

|

%

|

%

|

%

|

|

|

|

|

%

|

%

|

%

|

|

|

|

|

%

|

%

|

%

|

|

|

|

|

%

|

%

|

%

|

|

|

|

|

%

|

%

|

%

|

|

|

|

|

%

|

%

|

%

|

|

|

|

|

%

|

%

|

%

|

|

|

|

|

%

|

%

|

%

|

|

|

|

|

%

|

%

|

%

|

|

|

|

|

%

|

%

|

%

|

|

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 1125-E and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.