Understanding IRS Schedule M-2

Schedule M-2 is an important part of IRS Form 1120, the annual tax form corporations file with the IRS.

Master your retained earnings reconciliation and streamline your corporate filing with Kruze’s expert Startup Tax Returns services.

It is a key part of corporate tax reporting that shows changes in a company’s retained earnings from the start to the end of the tax year. It helps shareholders and the IRS understand important details, such as calculating a shareholder’s basis, handling dividends, and accounting for previously taxed income.

Schedule M-2 ties the unappropriated retained earnings shown on the company’s beginning and end-of-year balance sheets, as listed on Schedule L, and can also serve as a statement of retained earnings for financial reporting.

What Is The Purpose of Schedule M-2

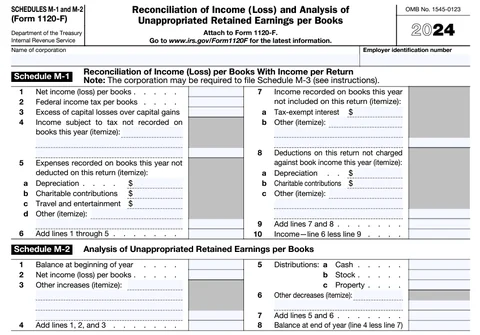

In addition to reconciling financial net income to taxable income on Schedule M-1, corporations are typically required to complete Schedule M-2 to analyze unappropriated retained earnings.

Schedule M-2 is essential for businesses because it shows how much money is available that isn’t reserved for specific uses.

In recent years, it has become even more significant as a place to report non-taxable income, such as forgiven loans from the Paycheck Protection Program (PPP). Schedule M-2 provides a clear record of changes in retained earnings, helping businesses report accurately and maintain transparency in their financial records.

Who Has To Complete Schedule M-2

Similar to Schedule M-1, a corporation’s asset and receipt levels determine whether Schedule M-2 is required.

Corporations with total receipts and year-end assets under $250,000 can skip Schedules L, M-1, and M-2 if they’ve checked “Yes” on Schedule K, question 13.

Keep in mind, do not file Schedules M-1 and M-2 (Form 1120-F) if the corporation’s total assets at the end of the tax year are less than $25,000 (as shown on line 17, column (d) of Schedule L).

Schedule M-2 Instructions

We strongly recommend working with an experienced tax preparer for personalized advice on filling out Schedule M-2, which is just one part of the corporate income tax return, Form 1120. While Form 1120 is due April 15, it can be extended until Oct. 15 by filing Form 7004.

You can also visit our C-Corporation tax deadlines calendar to see the current year deadlines.

Here are high-level instructions on filling out Schedule M-2.

Schedule M-2 on Form 1120 is used to reconcile the corporation’s retained earnings from the beginning to the end of the tax year. It provides a clear picture of changes in retained earnings by detailing net income, distributions, and other adjustments. Below is a step-by-step guide to completing each line of Schedule M-2:

- Balance at beginning of year: Enter the corporation’s balance of retained earnings at the beginning of the year.

- Net income (loss) per books: Record the net income (or loss) as shown in the corporation’s financial books.

- Other increases (itemize): Itemize and enter any other increases, such as tax-exempt interest income or life insurance proceeds from a life insurance policy.

- Add lines 1, 2, and 3: Add the amounts from Lines 1, 2, and 3, and enter the total.

- Distributions - 5a, 5b, 5c: Report distributions made during the year, with cash distributions on Line 5a, stock distributions on Line 5b, and property distributions on Line 5c.

- Other decreases (itemize): Enter any other decreases, such as non-deductible meals and entertainment expenses or premiums paid for officers’ life insurance policies.

- Add lines 5 and 6: Add the amounts from Lines 5 and 6.

- Balance at end of year (line 4 less line 7): Subtract the total on Line 7 from the total on Line 4 to calculate the corporation’s retained earnings at the end of the year.

Keep In Mind with PPP Loans:

If a corporation reports tax-exempt income from a PPP loan before the loan forgiveness is finalized and the forgiveness amount turns out to be less than originally reported, adjustments may be necessary. The corporation must record the difference as a reduction in tax-exempt income on Schedule M-2, line 6, for the year it is notified of the partial forgiveness. This ensures the corporation’s records are accurate and comply with tax rules.

The corporation also needs to attach a statement to Schedule M-2 to explain the adjustment. The statement should include the corporation’s name, address, and EIN; a note confirming that the adjustment follows section 3.03 of Revenue Procedure 2021-48; and details about the original tax-exempt income, including the tax year it was reported, the amount originally recorded, and the adjusted amount. This ensures transparency and helps the IRS understand how the corporation calculated its updated tax-exempt income.

Take full advantage of tax benefits for your startup

If you need help with startup tax planning, including general business credits, Form 1120, and whether you need to file a tax return at all, reach out to Kruze Consulting for help. We are experts at tax credits for startups.