Corporations filing Form 1120 may need to attach Schedule G if they have owners with substantial holdings.

This form helps the IRS track individuals or entities owning 20% or more of the corporation, or if one shareholder controls 50% or more of the total voting power of all stock. A huge percentage of the VC-backed startups that we work with require Schedule G.

It’s crucial to fill out Schedule G accurately to avoid penalties or audits, so make sure you are working with an experienced startup CPA firm that’s filed this many times for many different startups. We’ll guide you through what information you need and how to file it correctly, ensuring your corporation stays in compliance with IRS rules. But, we strongly recommend that you work with a qualified tax advisor, as corporate taxes are complicated!

Understanding IRS Form 1120 and its connection to Schedule G

Form 1120, the U.S. Corporation Income Tax Return, is used by domestic corporations to report their income, gains, losses, deductions, and credits to the IRS. It serves as the primary tax filing document for corporations operating within the United States. This form is crucial for determining a corporation’s taxable income and the amount of tax it owes for a given tax year. Even unprofitable startups need to file annual tax returns (and likely have state returns that need to be filed as well).

Schedule G is an extension of Form 1120 that is specifically required for corporations that have certain ownership or interest arrangements. It must be completed by corporations that have shareholders who own 20% or more of the filing corporation’s stock, or if any individual or entity that owns 50% or more of the total voting power of all classes of the corporation’s voting stock. Since many startups have VCs or investors who own large amounts of the company - or have a founder or two with high ownership stakes - this is a very, very common schedule for startups.

The IRS wants to know who the major owners of the corporation are and if anyone has voting control of the business; the purpose of Schedule G is to report information about these shareholders. Obviously, having a well maintained cap table is important (use a cap table software!), and this is why your tax CPA should be asking for it.

In essence, while Form 1120 reports the overall financial and tax position of the corporation, Schedule G focuses on disclosing significant ownership relationships. This ensures that the IRS has clear visibility into entities that may exert substantial influence over the corporation or benefit from its operations.

Why VC-backed startups, especially Delaware C-Corps, need to file Form 1120, even with no taxable income

VC-backed startups, particularly those structured as Delaware C-Corporations, are required to file Form 1120 regardless of whether they have taxable income. This requirement applies because a corporation is considered a separate legal entity from its owners, which means it must meet its tax obligations by filing an annual corporate tax return.

Even if a startup is in its early stages and hasn’t generated profits, filing Form 1120 is still mandatory. This filing helps the IRS track corporate activities, ensure compliance, and maintain up-to-date records for the business. It also provides a paper trail that can be critical in future funding rounds, audits, or legal matters.

For VC-backed startups, maintaining compliance is essential for preserving investor trust. Investors want to know that the company is managing its obligations and that no surprises will emerge due to unfiled tax forms. Smart investors ask for copies of the past several years’ tax returns during due diligence. The IRS asks for additional schedules to be attached to the tax return, and Schedule G is one of the more common ones that startups need to deal with, give their ownership structure.

Delaware C-Corps, which are often chosen for their favorable tax laws and business-friendly structure, are closely monitored for compliance by the IRS, making timely Form 1120 filings a key responsibility. Don’t miss key tax deadlines!

Who has to complete Schedule G?

Not every corporation needs to complete Schedule G—it’s required only for specific entities with certain ownership structures. For VC-backed startups and corporations with outside investors, especially Delaware C-Corps, this is a very common form.

The key determinant is whether the corporation has significant shareholders or voting stock. Your lawyers should be maintaining a cap table and have a good feeling for the company’s voting rights, so hopefully this isn’t hard to determine.

Generally, a corporation must complete Schedule G if it:

A corporation must complete Schedule G (Form 1120) if it answers “Yes” to Form 1120, Schedule K, Questions 4a or 4b. The actual requirements are:

- The corporation must report any foreign or domestic corporation, partnership, trust, or tax-exempt organization that owns directly 20% or more, or owns, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote.

- The corporation must report any individual or estate that owns directly 20% or more, or owns, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote

Again, work with an experienced startup tax CPA to make sure you understand the requirements for your particular situation.

Criteria for identifying significant voting stock shareholders

To determine which shareholders should be reported as significant voting stockholders on Schedule G of Form 1120, companies should consider the following criteria:

- Ownership Percentage: Shareholders who own 20% or more of the total value of the corporation’s stock are considered significant and must be reported.

- Voting Power: Any individual or entity that directly or indirectly owns 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote must be listed, which is surprisingly common for VC-backed startups that have issued preferred stock.

- Family Attribution Rules: Stock owned directly or indirectly by or for family members (including spouse, children, grandchildren, and parents) is considered as owned by the individual for the purpose of determining significant ownership.

- Indirect Ownership: Stock owned, directly or indirectly, by or for a corporation, partnership, estate, or trust is considered as being owned proportionately by its shareholders, partners, or beneficiaries. So if a VC owns part of another company that owns stock in the main company, and owns stock directly in the startup as well, you’ve got some math to do.

- Constructive Ownership: An individual is considered to own stock that they have an option to purchase, even if that option hasn’t been exercised.

- Reporting Period: The determination is based on stock ownership as of the last day of the tax year for which the return is filed.

It’s important to note that Form 1120 Schedule G requires reporting of all individuals or entities meeting these criteria, regardless of their influence on company decisions or special rights they may hold.

What goes on Schedule G?

Form 1120 Schedule G is designed to collect key details about a corporation’s ownership structure and stock. Here’s a breakdown of the specific information required:

- Information on Certain Persons Owning the Corporation’s Stock:

- Corporations must list any individual or entity that owned 20% or more of the total value of the corporation’s stock.

- Corporations must list any individual or entity that owned, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s voting stock.

- For each listed person, the corporation must provide their name, Taxpayer Identification Number (TIN), address, and percentage of stock owned.

Again, the form may not look too complicated, but every startup’s situation is unique, so work with a qualified tax advisor to make sure that you are providing complete and accurate information on Schedule G. Mistakes can cause IRS penalties! Corporations should carefully review their ownership records and stock issuances when completing this schedule, which is another reason working with a CPA who knows startups is a good idea.

Form 1120 Schedule G instructions

Step-by-step instructions for completing Schedule G of Form 1120

For official IRS guidance, always visit the IRS website. Consult with a qualified startup tax professional for personalized advice.

- Download Form 1120: Start by downloading the most recent version of Form 1120 and its accompanying instructions from the official IRS website: Forms & instructions | Internal Revenue Service.

-

Get your Cap Table: Ensure you have an up-to-date cap table that clearly shows the ownership percentages and voting rights for all shareholders.

- Locate Schedule G: Find Schedule G within Form 1120. It’s typically near the end of the form.

- Complete the Header: Fill in the corporation’s name and Employer Identification Number (EIN) at the top of Schedule G.

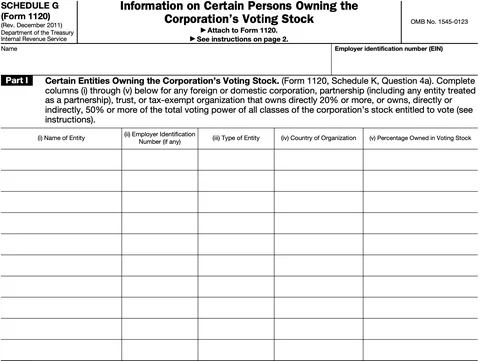

- Part I - Certain Entities Owning the Corporation’s Voting Stock:

- Complete this section for any foreign or domestic corporation, partnership, trust, or tax-exempt organization that owns directly 20% or more, or owns, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote.

- For each qualifying entity, provide: (i) Name of Entity (ii) Employer Identification Number (if any) (iii) Type of Entity (iv) Country of Organization (v) Percentage Owned in Voting Stock

- Part II - Certain Individuals and Estates Owning the Corporation’s Voting Stock:

- Complete this section for any individual or estate that owns directly 20% or more, or owns, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote.

- For each qualifying individual or estate, provide: (i) Name of Individual or Estate (ii) Identifying Number (if any) (iii) Country of Citizenship (see instructions for estates) (iv) Percentage Owned in Voting Stock

- Calculate Ownership Percentages: Use the constructive ownership rules outlined in the form instructions to determine indirect ownership. This may require tracing ownership through multiple entities or applying family attribution rules.

- Verify Information: Double-check all entries for accuracy, especially identifying numbers and ownership percentages.

- Attach to Form 1120 and file: File the completed Form 1120, including Schedule G, according to the IRS filing instructions. Remember to adhere to any specific filing deadlines to avoid penalties. See our detailed calendar for upcoming C-Corp deadlines in 2024.

- Seek Professional Assistance: If you’re unsure about any aspect of completing Schedule G, especially regarding complex ownership structures or constructive ownership rules, consult with a qualified tax professional who has experience with startup taxation.

Important Reminder: This information is for general guidance only. Always refer to the official IRS Form 1120 instructions for the most accurate and up-to-date details. For personalized tax advice, it’s best to consult a tax professional.

Common questions and challenges

1. What if my corporation has no taxable income? Even if your corporation has no taxable income, you must still file Form 1120 and Schedule G if it is a VC-backed startup or a Delaware C-Corp. The filing ensures compliance with IRS regulations and provides transparency about your corporation’s ownership and stock structure.

2. How do I handle changes in ownership or stock structure? Significant changes in ownership or stock structure will likely mean that you need to update your Schedule G, you can’t just use the one from last year.

3. What if I’m unsure about the types of stock to report? If you’re unsure which types of stock need to be reported, review your corporation’s stock issuance records. Common types include preferred stock and common stock. For detailed guidance, consult the Form 1120 instructions or seek advice from a tax professional.

4. How do I ensure the accuracy of the information? To avoid errors, double-check all entries on Schedule G, and verify the information against your corporation’s records and your cap table. It’s also beneficial to have a tax professional review the completed form to ensure accuracy and compliance.

5. What if I missed the filing deadline? If you missed the filing deadline, file the form as soon as possible to minimize potential penalties. The IRS may impose late filing penalties, so timely submission is crucial. This is another time it makes a lot of sense to bring on a professional!

Additional resources and tips

IRS Website: Access the latest IRS forms and instructions for Form 1120 and Schedule G directly from the IRS website.

Professional Advice: For specific concerns or complex situations, it’s advisable to consult with a qualified start-up tax professional who can provide tailored advice and ensure compliance.

Record Keeping: Maintain thorough records of ownership and stock transactions throughout the year to facilitate accurate reporting and compliance.

Conclusion

Filing Form 1120 and completing Schedule G accurately is essential for ensuring compliance with IRS regulations, particularly for VC-backed startups and Delaware C-Corps. Properly reporting shareholder information helps avoid costly penalties and keeps your corporation in good standing with the IRS.

While this guide provides a solid foundation for understanding the form and its requirements, tax filings can be complex. It’s always a good idea to consult with a qualified start-up tax professional to ensure you’re fully compliant and to address any unique aspects of your corporation’s tax situation.

(Form 1120)

| (i) Name of Entity | (ii) Employer Identification Number (if any) | (iii) Type of Entity | (iv) Country of Organization | (v) Percentage Owned in Voting Stock |

| (i) Name of Individual or Estate | (ii) Identifying Number (if any) | (iii) Country of Citizenship (see instructions) | (iv) Percentage Owned in Voting Stock |

see the Instructions for Form 1120.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official How to Fill Out Form 1120 Schedule G: A Guide for Startup Founders and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

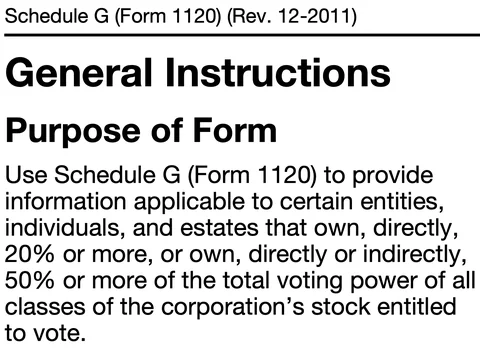

General Instructions

Purpose of Form

Use Schedule G (Form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote.

Who Must File

Every corporation that answers “Yes” to Form 1120, Schedule K, Questions 4a or 4b, must file Schedule G to provide the additional information requested for certain entities, individuals, and estates owning the corporation’s voting stock.

Constructive Ownership of the Corporation

For purposes of Schedule G (Form 1120), the constructive ownership rules of section 267(c) (excluding section 267(c)(3)) apply to ownership of interests in corporate stock and ownership of interests in the profit, loss, or capital of a partnership. An interest in the corporation owned directly or indirectly by or for another entity (corporation, partnership, estate, or trust) is considered to be owned proportionately by the owners (shareholders, partners, or beneficiaries) of the owning entity. Also, under section 267(c), an individual is considered to own an interest owned directly or indirectly by or for his or her family. The family of an individual includes only that individual’s spouse, brothers, sisters, ancestors, and lineal descendants.

An interest will be attributed from an individual under the family attribution rules only if the person to whom the interest is attributed owns a direct or an indirect interest in the corporation under section 267(c)(1) or (5). However, for purposes of these instructions, an individual will not be considered to own, under section 267(c)(2), an interest in the corporation owned, directly or indirectly, by a family member unless the individual also owns an interest in the corporation either directly or indirectly through a corporation, partnership or trust.

Example 1. Corporation A owns, directly, a 50% interest in the profit, loss, or capital of Partnership B. Corporation A also owns, directly, a 15% interest in the profit, loss, or capital of Partnership C and owns, directly, 15% of the voting stock of Corporation D. Partnership B owns, directly, a 70% interest in the profit, loss, or capital of Partnership C and owns, directly, 70% of the voting stock of Corporation D. Corporation A owns, indirectly, through Partnership B, a 35% interest (50% of 70%) in the profit, loss, or capital of Partnership C and owns, indirectly, 35% of the voting stock of Corporation D. Corporation A owns, directly or indirectly, a 50% interest in the profit, loss, or capital of Partnership C (15% directly and 35% indirectly), and owns, directly or indirectly, 50% of the voting stock of Corporation D (15% directly and 35% indirectly).

Corporation D reports in Part I that its voting stock is owned, directly or indirectly, 50% by Corporation A and is owned, directly, 70% by Partnership B.

Example 2. A owns, directly, 50% of the voting stock of Corporation X. B, the daughter of A, does not own, directly, any interest in Corporation X and does not own, indirectly, any interest in Corporation X through any entity (corporation, partnership, trust, or estate). Therefore, the family attribution rules do not apply and, for the purposes of Part II, the 50% interest of A in Corporation X is not attributed to B.

Example 3. A owns, directly, 50% of the voting stock of Corporation X. B, the daughter of A, does not own, directly, any interest in X but does own, indirectly, 10% of the voting stock of Corporation X through Trust T of which she is the sole beneficiary. No other family member of A or B owns, directly, any interest in Corporation X nor does any own, indirectly, any interest in Corporation X through any entity. Neither A nor B owns any other interest in Corporation X through any entity.

For the purposes of Part II, the 50% interest of A in the voting stock of Corporation X is attributed to B and the 10% interest of B in the voting stock of Corporation X is attributed to A. A owns, directly or indirectly, 60% of the voting stock of Corporation X, 50% directly and 10% indirectly through B. B owns, directly or indirectly, 60% of the voting stock of Corporation X (50% indirectly through A and 10% indirectly through Trust T).

Specific Instructions

Part I

Complete Part I if the corporation answered “Yes” to Form 1120, Schedule K, Question 4a. List each foreign or domestic corporation, partnership, trust, or taxexempt organization that owns, at the end of the tax year, directly 20% or more, or owns, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote. Indicate the name of the entity, employer identification number (if any), type of entity (corporation, partnership, trust, or taxexempt organization), country of organization, and the percentage owned, directly or indirectly, of the voting stock of the corporation.

For an affiliated group filing a consolidated tax return, list the parent corporation rather than the subsidiary members. List the entity owner of a disregarded entity rather than the disregarded entity. If the owner of a disregarded entity is an individual rather than an entity, list the individual in Part II.

Part II

Complete Part II if the corporation answered “Yes” to Form 1120, Schedule K, Question 4b. List each individual or estate that owns, at the end of the tax year, directly 20% or more, or owns, directly or indirectly, 50% or more, of the total voting power of all classes of the corporation’s stock entitled to vote. Indicate the name of the individual or estate, taxpayer identification number (if any), country of citizenship (for an estate, the citizenship of the decedent), and the percentage owned, directly or indirectly, of the voting stock of the corporation.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official How to Fill Out Form 1120 Schedule G: A Guide for Startup Founders and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.