As one of the leading accounting and finance advisors to VC-backed startups, we get asked about startup revenue models.

Founders asking these questions are usually looking for one of two things:

- A revenue model template that they can use to forecast their startup’s revenue (scroll down to get our free model templates)

- Guidance on the right revenue models (i.e. business or pricing model) that they should use

In this article we’ll write up the advice that we typically offer on these two topics.

Revenue Models for Startups: Templates and Strategies

As one of the leading accounting and finance advisors to VC-backed startups, we frequently receive inquiries about startup revenue models.

Founders asking these questions are usually looking for one of two things:

- A revenue model template they can use to forecast their startup’s revenue

- Guidance on the right revenue models (i.e., business or pricing model) they should use

In this article, we’ll address both of these topics, starting with our revenue model template and followed by advice on various business models for startups.

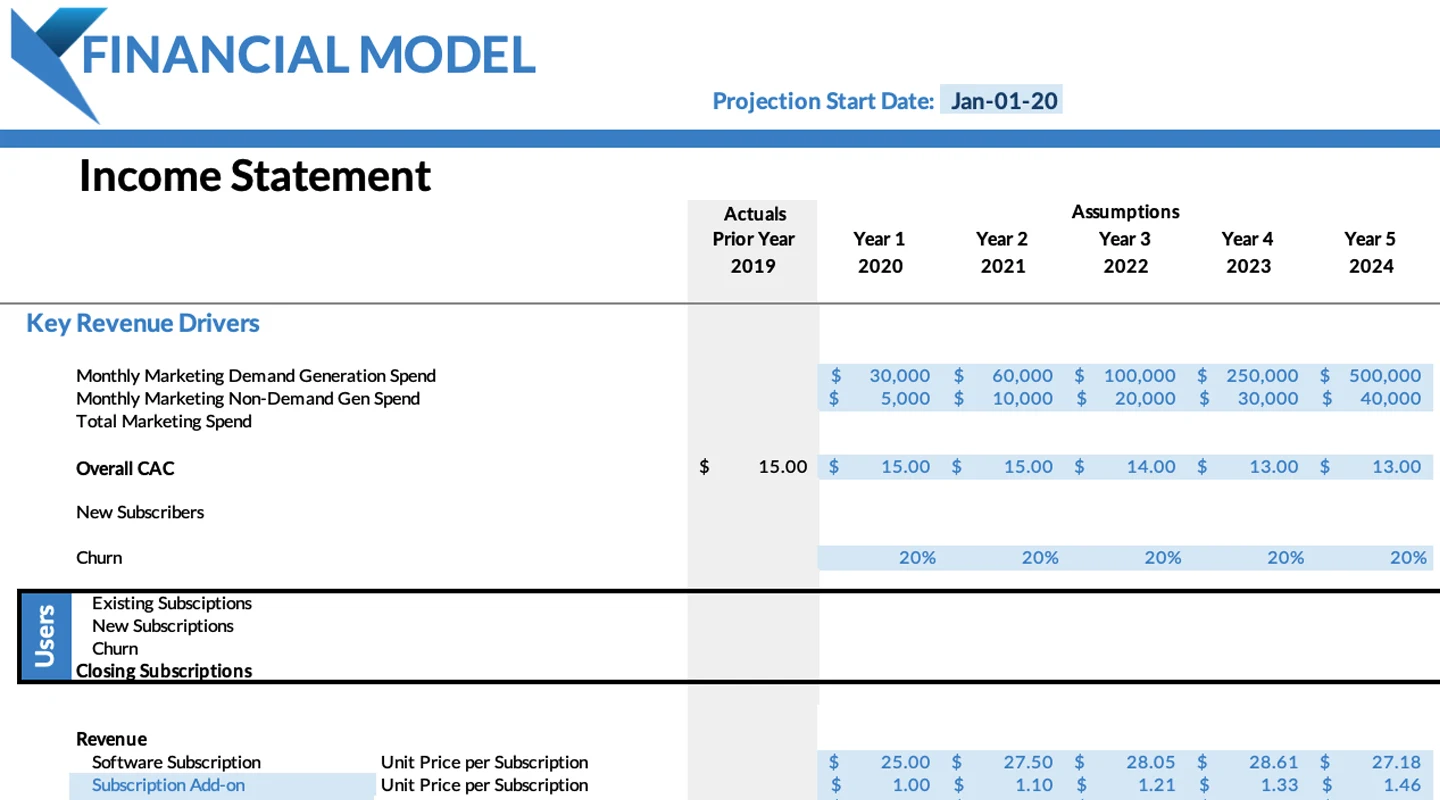

Part 1: Revenue model template for startups

Forecasting your startup’s revenue is crucial for financial planning, fundraising, and strategic decision-making. To help you with this critical task, we’ve created projection templates that you can download and customize for your business. You can access all of our startup financial models here, or get the SaaS revenue model template by clicking the template below.

These templates are helpful when you are first getting started - having an idea of what your revenue potential is can help you decide if you want to start a business, how much you should price and more.

Features of our revenue model template

Our template is designed to help you:

- Project monthly recurring revenue (MRR)

- Estimate customer acquisition and churn rates

- Forecast annual recurring revenue (ARR)

- Calculate customer lifetime value (LTV)

While this template is tailored for SaaS businesses, the principles can be adapted to other revenue models as well. We plan to add more industry-specific templates in the future to cater to a wider range of startup types.

How to use the revenue model template

- Download the template from our website

- Input your current customer data and historical growth rates

- Adjust assumptions for customer acquisition, churn, and pricing

- Review the projected revenue and key metrics

- Use the insights to inform your business strategy and financial planning

Remember, a revenue model is just one part of your overall startup financial model. It’s crucial to integrate this with your cost projections, cash flow forecasts, and other financial statements to get a complete picture of your startup’s financial health.

Tips for projecting your startup’s revenue

If you haven’t started the business, or if you are pre-revenue, we’d encourage you to keep your sales forecasting high-level. Many founders we work with are excited to think about their pricing strategy and will spend hours modeling subscription tiers, overage fees, and other bells and whistles on how they are going to generate revenue.

This is something we kind of aggressively discourage!

You aren’t going to know what your pricing strategy will be until after you’ve talked to a number of potential customers, and until you’ve found prices and pricing schemas that they will actually pay for. So, we’d encourage you to not spend that time modeling, and instead talk to customers.

For pre-revenue companies, the way we’d suggest modeling revenue is:

Projected number of customers X average revenue per customer = revenue estimate

That will keep your spreadsheet time to a minimum, and keep you focused on creating and selling a product at the desired ASP to the targeted number of customers.

Ok, now onto the other section in this article:

Part 2: Popular revenue models for startups

Choosing the right business model is a critical decision for any startup.

Here are some of the most common and effective revenue models used by successful startups:

1. Subscription revenue model

The subscription model has gained significant popularity, especially among Software as a Service companies. In this model, customers pay a recurring fee (usually monthly or annually) to access a product or service. If you see the term ARR, it should be SaaS. As one of the leading SaaS accountants, this is the most popular business model that we see.

Pros:

- Predictable, recurring revenue

- Higher customer lifetime value

- Easier to forecast and plan

Cons:

- Pressure to continually provide value to retain subscribers

- Can challenge cash flow, since customers pay over time instead of upfront

Examples: Netflix, Salesforce, Hubspot

2. Freemium revenue model

The freemium model offers basic features for free while charging for premium features or additional functionality.

Pros:

- Low barrier to entry for new users

- Opportunity to upsell to paying customers

- Potential for rapid user growth, which can lead to rapid product learning

Cons:

- Need to balance free and paid features

- May struggle to convert free users to paying customers

Examples: Dropbox, LinkedIn, Slack

3. Transactional revenue model

In this model, revenue is generated from individual transactions or sales of products or services. eCommerce is the most common/classic type of company using this type of business model.

Pros:

- Clear value proposition for customers

- Potential for high-margin sales

- Easier to understand and implement

- Web sales can be highly scalable

Cons:

- May lead to fluctuating revenue

- Requires continuous marketing efforts

- Harder to determining value of a new customer since you need to remarket to get them to purchase again

Examples: Amazon, Target/Walmart, Classic Tees

4. Advertising revenue model

This model generates revenue by displaying ads to users, often used by platforms with large user bases.

Pros:

- Can be lucrative with a large user base

- Allows for free service to users

Cons:

- Requires a significant number of users to be profitable

- May negatively impact user experience

- Fluctuations in the ad market can dramatically change revenue outlook

Examples: Google, Facebook, newspapers

5. Marketplace revenue model

Marketplace models connect buyers and sellers, taking a commission on transactions.

Pros:

- Scalable business model

- Network effects can lead to rapid growth

- Network effects can be powerful moat

Cons:

- Requires building both supply and demand sides - very hard

- May face competition from direct seller-buyer relationships

- Don’t totally control the customer experience

Examples: Airbnb, Uber, eBay

6. Licensing revenue model

This model involves granting permission to other businesses or individuals to use your intellectual property, technology, or brand in exchange for a fee. The fee can either be fixed, or a percent of sales.

Pros:

- Can generate passive income

- Allows for expansion into new markets without significant capital investment

- Potential for high profit margins

Cons:

- Less control over revenue growth because you don’t control sales and marketing for the end product

- May require significant legal resources to manage and enforce agreements

- Potential loss of control over brand or product quality

Examples: ARM (chip designs), Dolby

7. Affiliate revenue model

In this model, businesses earn commissions by promoting other companies’ products or services and driving sales through unique referral links.

Pros:

- Low startup costs and overhead

- Potential for passive income

- Can complement existing content or product offerings

Cons:

- Generally not a venture-scale business model

- Reliance on partners’ product quality and customer service

- Commissions can be volatile or change unexpectedly

- Requires consistent traffic or a large audience to be profitable

Examples: Amazon Associates, Red Ventures, Tripadvisor

8. Crowdfunding revenue model

Some startups first generate revenue by doing a crowdfunding campaign. This model involves raising small amounts of money from a large number of people, typically through online platforms, to fund a project or venture.

Pros:

- Can validate product ideas before full development

- Builds a community of supporters and early adopters

- Potential for rapid funding and market exposure

- Can lead to VC interest

Cons:

- Success often depends on marketing efforts and network reach

- May require fulfilling promises to backers, which can be challenging

- Platforms usually take a percentage of funds raised

- Can bring copycats into the market

Examples: Allbirds, Tile, Oculus VR

9. Retail sales model

The retail sales model involves selling products directly to consumers through physical stores, online platforms, or a combination of both (omnichannel retail). Many direct to consumer brands eventually open their own retail stores.

Pros:

- Direct control over customer experience and brand presentation

- Potential for higher profit margins by eliminating intermediaries

- Opportunity for immediate customer feedback and product iteration

- Smart real estate plays have value

Cons:

- Requires significant upfront investment in inventory and/or physical locations

- Managing supply chain and logistics can be complex and costly

- Retailers may or may not control their product, depending on who owns the brands inside the stores

- Scaling can be capital-intensive, especially for brick-and-mortar stores

- Difficult to raise venture funding for these businesses

Examples: Target, Warby Parker, Casper

10. Value-Added Reseller (VAR) sales model

VARs purchase products from manufacturers, add features or services, and then resell these enhanced offerings to end-users. This is not generally a business that raises venture capital funding, although many large VARs may become private equity targets.

Pros:

- Ability to create unique product offerings tailored to specific market needs

- Can leverage existing products and technologies to create new solutions

- Potential for building long-term relationships with both suppliers and customers

Cons:

- Margins can be squeezed between supplier costs and competitive pricing pressures

- Dependent on suppliers for core products and vulnerable to changes in their strategies

- Requires ongoing investment in expertise and service capabilities to maintain value-add

Examples: CDW (IT products and services), Arrow Electronics, Insight (IT solutions provider)

Conclusion

Choosing the right revenue model and accurately forecasting your startup’s income are critical steps in building a successful business. By using our revenue model template and understanding the pros and cons of different business models, you’ll be better equipped to make informed decisions about your startup’s financial strategy.

Remember that both your pricing strategy and your business model may evolve as your business grows and market conditions change. Stay flexible and be prepared to adapt your approach as needed. If you need help with your startup revenue accounting or financial modeling, don’t hesitate to reach out to financial experts who specialize in working with startups.

By leveraging the right revenue model and using accurate forecasting tools, you’ll be well on your way to building a financially sound and successful startup.