Startup founders often introduce innovative technologies into the marketplace and build their businesses around them.

However, many founders may not realize that developing new products or services can also create a significant tax opportunity: the Research and Development (R&D) tax credit.

This tax credit can help offset the costs of innovation, reducing tax liabilities and freeing up capital to reinvest in the business.

Even though the rules have changed recently, the tax credit can still reduce your startup’s tax bill You can use our R&D tax credit calculator to estimate how much the credit could be worth to your startup.

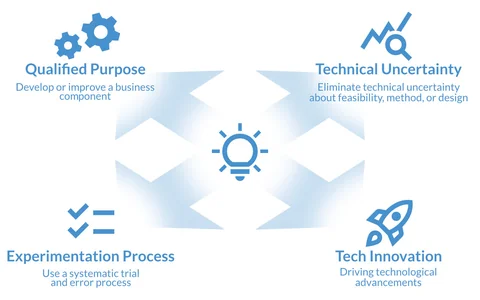

However, to qualify, a company’s activities must meet all four elements of the IRS’s four-part test under the Internal Revenue Code. These tests must be applied separately to each of the startup’s business components (more on this below). Here’s a breakdown of the four-part test.

Your startup’s R&D must have a qualified purpose

Your research activities must aim to develop or improve a business component. A business component is any product, process, software, technique, or invention used in the company’s business. Whether you’re working on a new product or improving an existing business component, the key is that your research must advance functionality, performance, or quality. Areas like computer sciences and biological sciences often fall under this criterion, but it applies across a range of industries.

Your research must try to eliminate technical uncertainty

One of the core elements of the R&D tax credit is whether your work aims to eliminate technical uncertainty. This uncertainty involves questions about the feasibility, method, or design of your project. For example, if your team is working on an algorithm that will improve an existing business component in computer science, and you’re unsure whether it can achieve the desired performance, your research likely qualifies.

Your R&D uses the process of experimentation

This requirement involves systematic trials or testing to eliminate technical uncertainties. Research activities should fundamentally rely on experimentation in fields such as physical or biological sciences or computer science. Your company must engage in trial and error, testing various hypotheses to solve technical challenges. Startups often experiment with different materials, designs, or coding methods to enhance their business component, which is a vital aspect of this test.

Your research is technological in nature

The research must rely on principles from physical or biological sciences, computer sciences, or engineering. Whether your startup is building new technology or trying to improve a commercial production process, your research must fundamentally rely on these scientific principles. For instance, a tech startup optimizing a software feature would qualify if the underlying improvements are based on computer science principles.

Why founders need to know about the 4-part test

Startups often spend significant resources on innovation, whether through product development, software engineering, or contract research with external partners. The R&D tax credit can provide substantial financial benefits, but understanding the IRS’s four-part test is essential to maximize your claims. The tax credit covers a taxpayer’s funded research activities like product development or even specific outsourced research if it meets the test’s criteria.

Founders should also make sure their employees understand the R&D tax credit. It’s worth the time to conduct employee training programs to explain the process and requirements. Employees can help founders:

- Identify eligible activities. Employees are usually the best source for identifying qualifying activities and expenses.

- Capture all eligible costs. Employees who understand the R&D tax credit are more likely to properly document their time and expenses to help the company take full advantage of the credit.

- Document research activities. If employees regularly document research activities throughout the year, that reduces the risk of missing key information, avoids panic to collect info at tax time, and makes audits less likely.

If your company is engaged in qualifying activities, the research tax credit can help fund further research, retain key employees, or expand business management operations. Whether you are developing an improved business component or tackling technical uncertainty, R&D tax credits are a powerful tool to help your startup grow.

Consult an expert in startup taxes

Don’t overlook the opportunity to claim these tax credits. Many startups, especially in technology or life sciences, may already be engaged in activities that meet the qualified research requirements without realizing it. In addition, there are other tax credits that your startup may be eligible to claim.

If you’re unsure whether your work qualifies, Kruze Consulting can help assess your eligibility for the R&D tax credit and guide you through the process, and help you determine if there are other credits that may be available for your startup.