FORM 5472 Instructions, Tips and Where to File

Form 5472: Disclosing international transactions

More and more businesses are operating on a global level, even small businesses and startups. In recognition of that fact, the IRS requires US businesses that have foreign ownership, or foreign businesses that do a significant amount of business in the US to file Form 5472.

The form discloses information about reportable transactions, and is submitted along with IRS Form 1120, your annual tax return. Form 5472 differs from Form 5471, which is used for US citizens that have ownership in foreign corporations.

Form 5472 Introduction Video

IRS Form 5472 is a tax form that is required to be filed by foreign individuals or corporations that own more than 25% of a startup. It is necessary to file the Form 5472 along with the annual tax return for corporations, Form 1120. Failure to file this form can result in fines that can be in the tens of thousands of dollars, per form! So don’t forget to file. And, thankfully, there is a process for abating this fine with the IRS, if it is the first year and the proper steps are taken - a good CPA like Kruze should be able to help you.

In addition to the general information, Form 5472 will also include vital statistics of the firm and the foreign person, as well as transactions between the two, such as payroll, loans, sales, etc. The form is due on April 15th, but can be filed with an extension until October 15th.

If you own more than 25% of a corporation or have a strategic investor who owns more than 25%, it is crucial to inform your tax preparer or CPA about the requirement to file Form 5472. At Kruze Consulting, we specialize in serving venture-backed startups and are well-versed in the requirements for foreign shareholders and foreign subsidiaries, including IRS Form 5472.

Five facts about Form 5472

Form 5472 is designed to make sure startups and other companies comply with U.S. tax laws that monitor foreign investments and prevent tax evasion. Filing Form 5472 is mandatory if a reportable transaction, such as sales, leases, loans, or payments, occurs between a reporting corporation and a foreign-related party during the tax year. Here’s a quick overview of important facts founders need to know about Form 5472.

- It’s required for any startup that has more than 25% foreign ownership.

- You’ll need to file it with your income tax return, Form 1120, for each foreign owner.

- You’ll need to supply detailed information about any activity between the startup and a foreign owner.

- Penalties are very expensive if you don’t comply.

- Form 5472 is complicated so consult a CPA.

Who needs to file?

If 25 percent or more of your US-based corporation is owned by a foreign individual (which can include both businesses and individuals), you will need to file Form 5472. In addition, any company that’s foreign and is engaged in a US trade or business must file. Finally, some US LLCs that are owned by foreign entities may need to file. If your company has multiple foreign shareholders, a separate Form 5472 must be filed for each.

What do I need to provide to my startup CPA?

To complete Form 5472, your CPA will need the following information about any foreign shareholders:

- Name

- Address

- Percentage of shares owned

- US tax identification number, if available

What information is disclosed?

The IRS wants you to include all “reportable transactions” on Form 5472, and defines that term very broadly as basically any activity carried out between a US corporation and a foreign owner. Some examples include any money or property exchanged, loans or interest payments, and any use of US property by foreign owners.

What if you don’t file?

If you’re required to file Form 5472 and don’t do so in a timely manner, you can be penalized with a $25,000 fine, plus an additional $25,000 for each month you fail to file, starting 90 days after you’re notified by the IRS of the failure to file Form 5472. There’s no maximum limit to this penalty, so the fine can grow quickly to a very significant amount. While it’s possible to appeal the penalty, that process can be very difficult.

Requirements for Filing Out Form 5472

Corporations use Form 5472 to report information about their foreign shareholders and any financial dealings with related foreign entities. The form collects key details about the company’s structure, ownership, and business activities. It requires corporations to disclose essential data to ensure transparency in international financial transactions and compliance with U.S. tax regulations.

The following key information is required to complete Form 5472:

- Corporate structure and ownership: You’ll need to provide the names, addresses, and ownership percentages of all foreign shareholders. This helps clarify who owns the company and how much they control.

- Reportable transactions: Form 5472 requires details about any financial transactions between the corporation and related foreign entities. This includes things like sales, rents, royalties, and loans.

- Business details: Companies must disclose the country where they are incorporated and describe their main business activity.

Guide To Filling Out Form 5472

Form 5472 can be complex for small business owners to navigate and requires filling out all nine parts accurately, so we strongly recommend that you work with an experienced tax preparer.

Here are high-level instructions on how to fill out Form 5472.

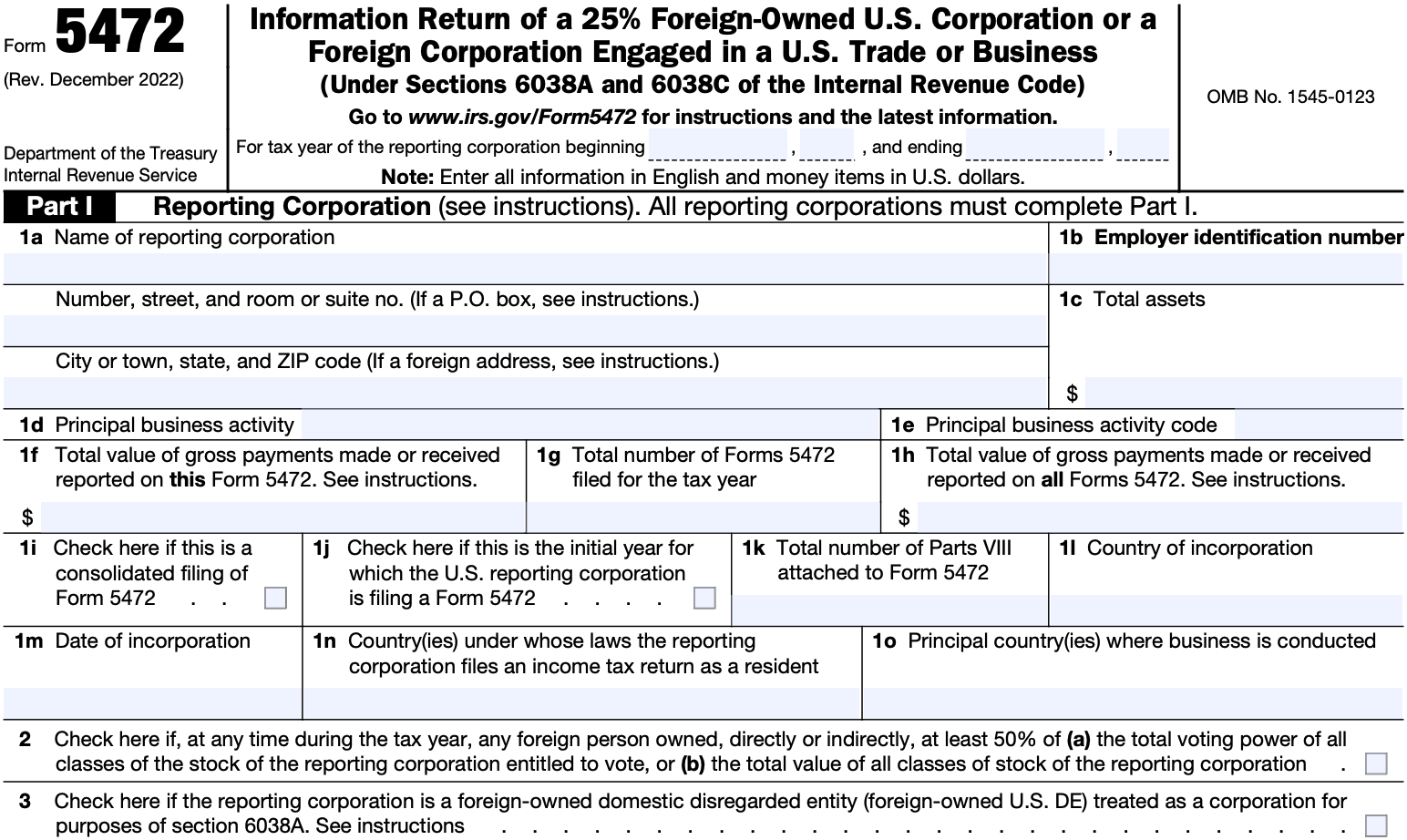

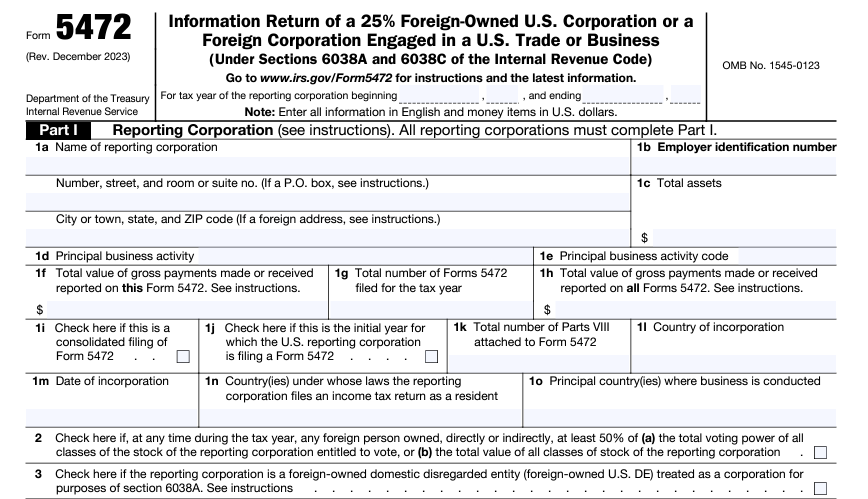

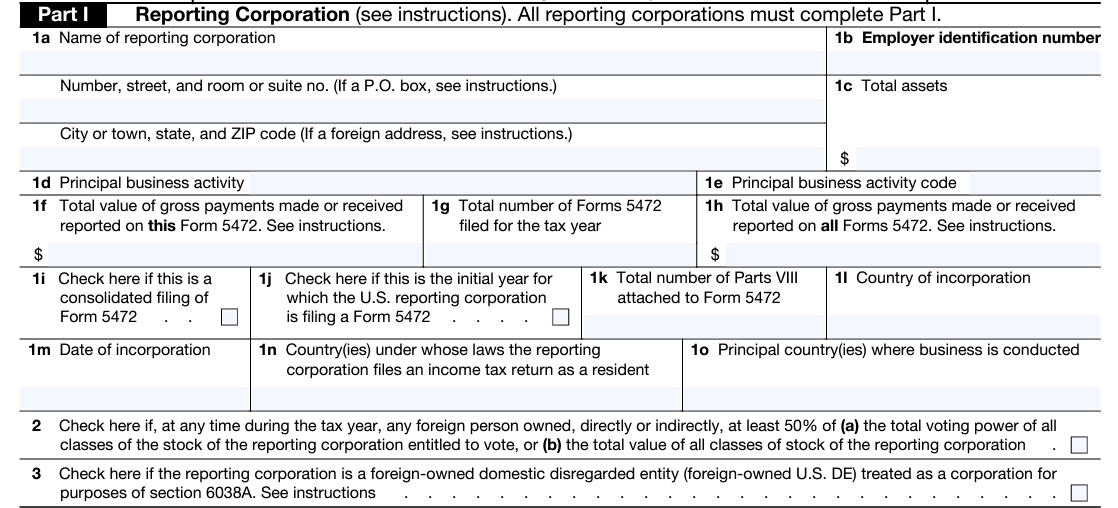

Step 1: Reporting Corporation

Part I of Form 5472 focuses on key details about a corporation’s operations, ownership, and transactions with foreign entities.

- Basic Information: Start by providing the corporation’s tax year dates, name, address, Employer Identification Number (EIN), and total assets. For LLCs, the address can be a foreign one, but it should ensure that IRS notices reach the responsible person.

- Business Activity: Enter a description of the company’s main business activity along with the appropriate activity code. You can find these codes in the instructions for Form 1120 on the IRS website.

- Reporting Foreign Transactions: If the corporation had any financial transactions with foreign related parties, report the total amount on line 1f. Related parties include foreign shareholders with at least 25% ownership and anyone related to them or the corporation. Transactions with U.S.-related parties don’t need to be reported on this line. On line 1g, list how many Forms 5472 you’re filing if there are multiple related parties.

- First-Time Filers and Consolidated Filings: Use lines 1i and 1j to indicate if the form is a consolidated filing or if it’s the corporation or LLC’s first time submitting Form 5472. Foreign-owned LLCs should also check box 3 to confirm their status as disregarded entities.

- Additional Details: Lines 1k to 1o gather more specifics. These include details about cost-sharing arrangements, the corporation’s country of incorporation, incorporation date, and where it files taxes as a resident. Also, specify the main country or countries where the business operates.

- LLC Residency and Tax Treatment: The IRS considers single-owner LLCs as disregarded entities, meaning they are not separate from their owners for tax purposes. The LLC itself is not liable for U.S. tax and cannot claim U.S. residency under tax treaties; the income is taxed in the hands of the owner. Be sure to fill out all relevant lines, especially if the LLC has had multiple transactions with related parties.

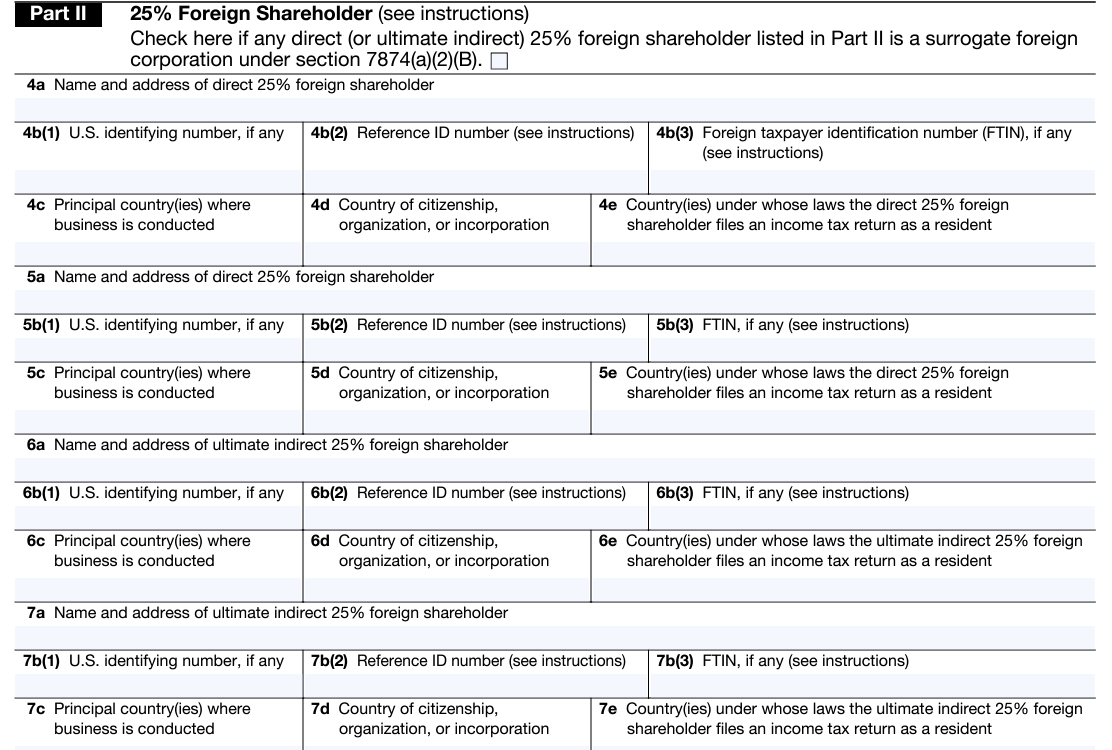

Step 2: 25% Foreign Shareholder

Part II of Form 5472 focuses on gathering essential information about the LLC’s foreign owner or any 25% foreign shareholder.

- Foreign Owner’s Information: Provide the name and address of the foreign owner. This could be an individual who is not a U.S. citizen or resident, or a foreign company, partnership, association, estate, or trust.

- Tax Identification Numbers: If the owner does not have a U.S. Tax Identification Number (TIN), they should use a foreign Tax Identification Number (FTIN). If neither is available, write “none” or “n/a” on the form.

- Reference Identification Number (RIN): If a foreign TIN or U.S. TIN is not provided, a Reference Identification Number must be created. This is a unique identifier chosen by the filer, which:

- Must be 50 characters or less and only include letters and numbers (no special characters or spaces).

- The RIN should be retained and reused consistently each tax year for continuity.

- Does not require an application to the IRS, as it is self-assigned.

- Consistent Use of Reference ID: Since the Reference ID is used to track the foreign shareholder each year, it is crucial to record and maintain this number for future filings.

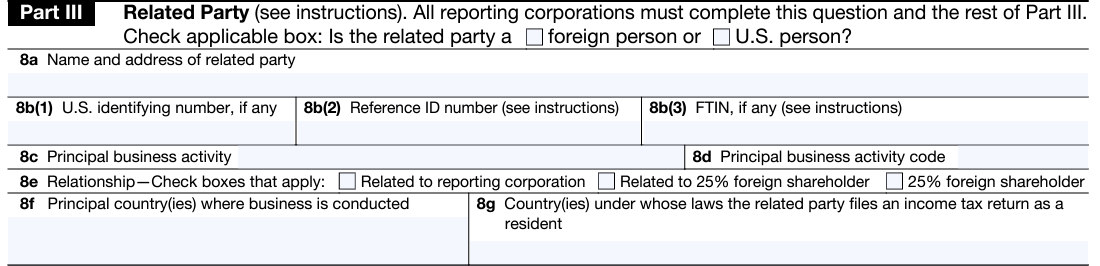

Step 3: Related Party

Part III of Form 5472 is about reporting “Related Parties” that the LLC or corporation had reportable transactions with during the tax year.

- Provide Related Party Details: Include the name and address of each related party, whether they are based in the U.S. or abroad. This could be the foreign owner or other entities connected to the business, like companies within the same group or family members.

- Tax ID or Reference ID: If the related party doesn’t have a U.S. Tax Identification Number (TIN), you’ll need to assign a Reference Identification Number (RIN) for tracking. This is especially useful for foreign entities.

- Business Information (if relevant): For business entities, add the principal business activity and activity code. If the related party is an individual, you can skip this step.

- Specify Ownership Status: Indicate if the related party is a 25% foreign shareholder, related to the corporation, or connected to a 25% foreign shareholder.

- Country Information: List the main country where the related party does business and where they file income taxes.

- Separate Forms for Each Party: A separate Form 5472 must be filed for each related party with reportable transactions, ensuring all financial relationships are properly documented.

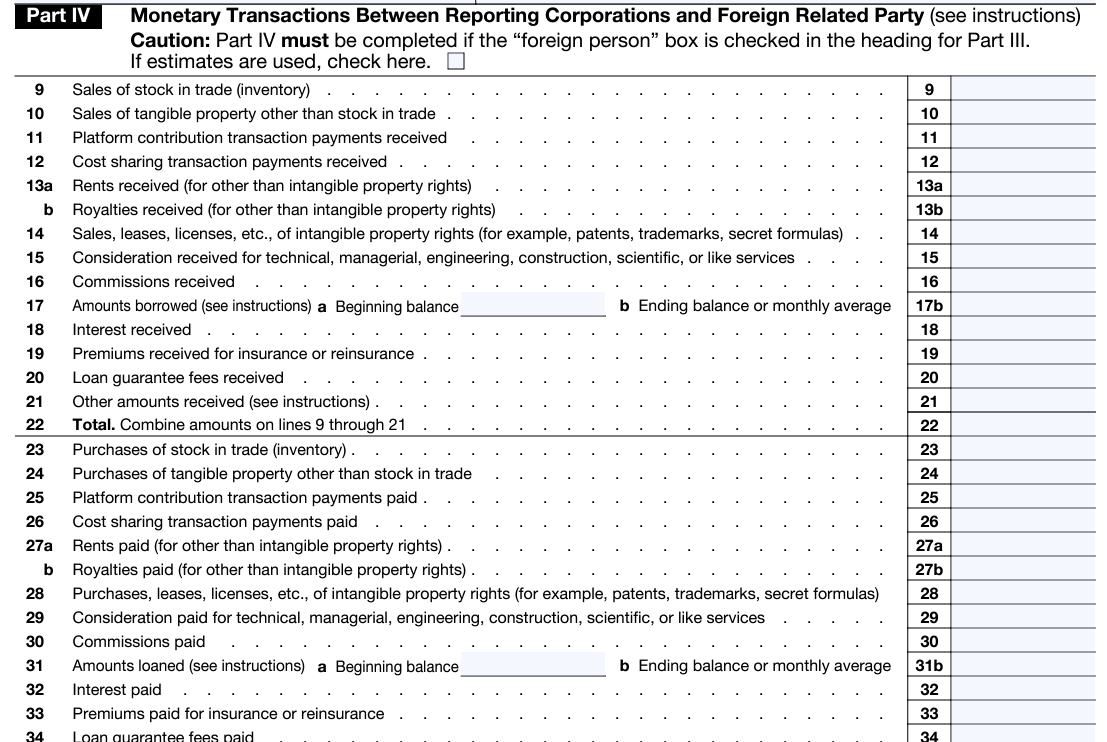

Step 4: Monetary Transactions Between Reporting Corporations and Foreign Related Party

Part IV of Form 5472 is used to report all monetary transactions between the corporation and its foreign-related parties. It’s important to note that this section is only for transactions with foreign entities, not domestic ones. Here, businesses will detail primary financial dealings, but many of these may not apply to foreign-owned disregarded entities. If the LLC has had other transactions with its owner or related parties that aren’t covered in Part IV, a box must be checked in Part V to report those separately.

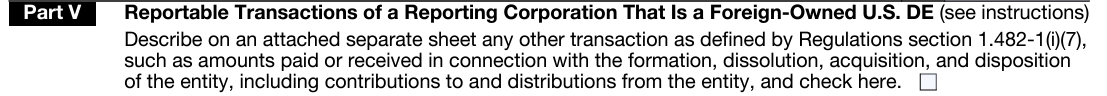

Step 5: Reportable Transactions of a Reporting Corporation That Is a Foreign-Owned U.S. DE

Part V of Form 5472 is for foreign-owned U.S. disregarded entities (DEs) to report transactions that aren’t covered in Part IV. This includes any amounts paid or received in connection with the formation, dissolution, acquisition, or sale of the entity, as well as contributions to and distributions from the LLC. If this section applies, the business must check the box in Part V and provide details of these transactions on a separate attached sheet.

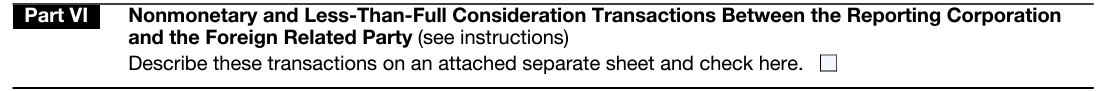

Step 6: Nonmonetary and Less-Than-Full Consideration Transactions Between the Reporting Corporation and the Foreign Related Party

Part VI of Form 5472 is used to report any non-monetary or partial transactions between the LLC and its foreign-related parties. If the LLC had these types of transactions, a detailed statement must be attached. This statement should describe any property, rights, or services exchanged between the LLC and the foreign party, along with a reasonable estimate of their fair market value (FMV). If the FMV isn’t available, another reasonable indicator of value can be used.

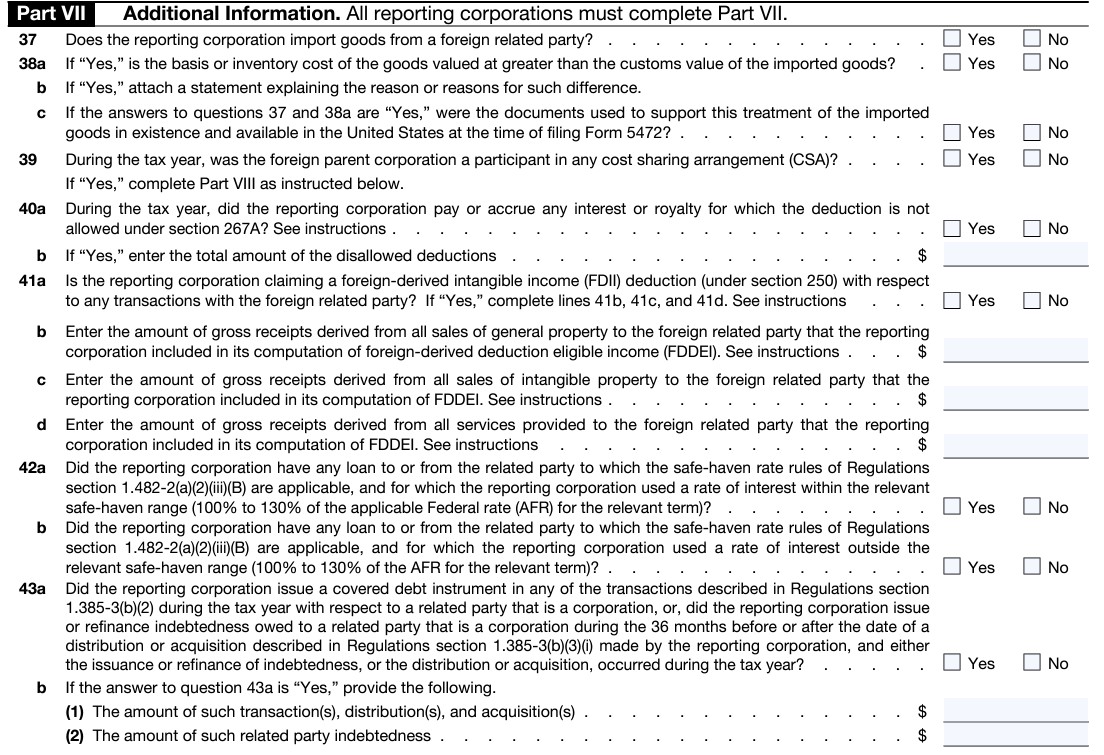

Step 7: Additional Information

Part VII of Form 5472 is where the reporting corporation must answer a series of yes-or-no questions. Although most answers will typically be “no,” it’s still crucial to read each question carefully and ensure accurate responses. Businesses should gather complete information from clients to avoid errors, as mistakes or missing documentation can result in significant penalties.

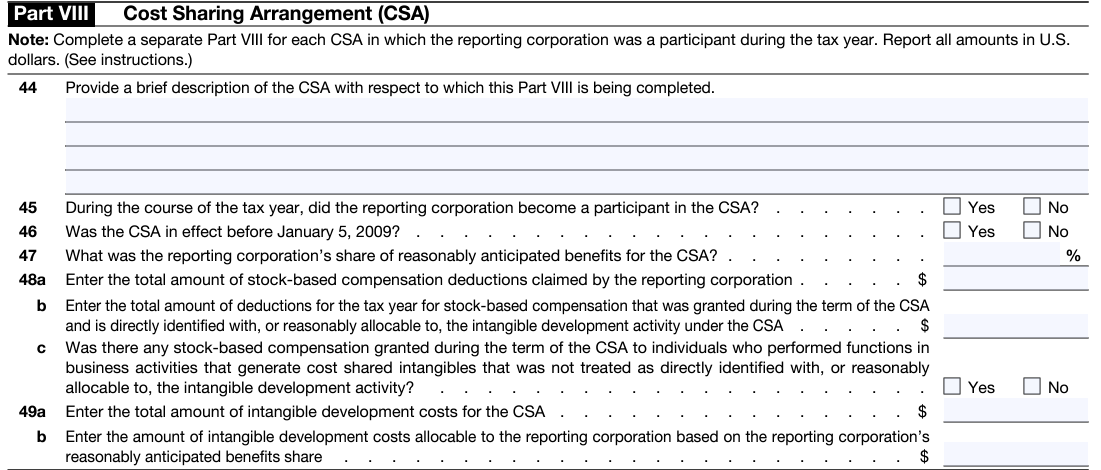

Step 8: Cost Sharing Arrangement (CSA)

Part VIII of Form 5472 is used to report details about any cost-sharing arrangements (CSAs) the reporting corporation had with foreign-related parties during the tax year.

- Describe the CSA: On line 44, provide a brief description of the CSA to distinguish it from other arrangements.

- Share of Benefits: On line 47, enter the corporation’s share of reasonably anticipated benefits (RAB) from the CSA for the tax year.

- Stock-Based Compensation: Lines 48a, 48b, and 48c require details on any stock-based compensation related to the CSA.

- Intangible Development Costs: Fill in lines 49a and 49b with information about costs associated with intangible development.

Each CSA must be reported separately, so make sure to complete a separate Part VIII for each arrangement and carefully review all information before submission.

Step 9: Base Erosion Payments and Base Erosion Tax Benefits Under Section 59A

Part IX of Form 5472 requires the reporting corporation to disclose any base erosion payments and tax benefits with related foreign parties during the tax year.

- Base Erosion Payments (Line 50): Enter the total amount of base erosion payments made by the corporation. These include payments to foreign-related parties for which deductions are allowed, such as payments related to depreciable property, reinsurance, or expatriated entities. Refer to specific sections of the tax code for further details on what qualifies as a base erosion payment.

- Base Erosion Tax Benefits (Line 51): Report the total base erosion tax benefits, which are deductions related to base erosion payments. This can also include certain reductions in premiums or gross receipts connected to reinsurance payments or expatriated entities.

- Qualified Derivative Payments (Line 52): Provide the amount of qualified derivative payments, which are payments made according to derivatives treated as ordinary income or loss. These are not considered base erosion payments and should be calculated separately.

- Reserve Payments: If any payments are reserved for future use, make sure to check the appropriate box to indicate this.

Written by Kruze founder and CPA

Vanessa Kruze, a highly-experienced CPA, brings valuable tax expertise to startups, drawing from her rich background at Deloitte Tax and as a financial controller for a $20 million startup. As the leader of Kruze Consulting, recognized multiple times in the Inc 5000 list, she specializes in navigating the complex tax landscape for startups. Her firm is known for delivering precise and strategic tax solutions, delivering tax credits utilizing advanced tools to ensure compliance and optimize tax benefits for startups throughout the United States.

Consult a tax professional

IRS Form 5472 is very complex, and your startup should rely on an experienced tax professional to evaluate your need to file, and to help you properly complete all the forms and provide necessary information. If you’ve got questions about Form 5472 or any other tax forms, contact us at Kruze Consulting.

How to get the Form 5472

You can find the official Form 5472 on the IRS’ website. Always go directly to the IRS’ site to get the form, as they tend to have minor changes from year to year. You can get the IRS Form 5472 by clicking here to visit the Internal Revenue Service’s page about Form 5472.

Form 5472

Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business

(Under Sections 6038A and 6038C of the Internal Revenue Code)

▶ Go to www.irs.gov/Form5472 for instructions and the latest information

For tax year of the reporting corporation beginning _ _ _ _ _ _ _ _ and ending _ _ _ _ _ _ _ _ , 20_ _

Note: Enter all information in English and money items in U.S. dollars.

OMB No. 1545-0123

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 5472 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 5472 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 5472 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.