FORM 6765: EVERYTHING YOU NEED TO KNOW

Credit for Increasing Research Activities

What is Form 6765?

Form 6765 is an IRS Form, under IRS tax code U.S. Code § 280C, that is the “Credit for Increasing Research Activities” - and informally known as the R&D Tax Credit Form. This tax form can help startups save up to $250,000 on their payroll taxes. And that amount will double to $500,000 starting in the tax year 2023 thanks to the Inflation Reduction Act. The Research and Development tax credit basically rewards companies for conducting research and development activities within the United States.

Who should file Form 6765?

Form 6765 is for startups who engaged in qualified research & development activities, as defined by the IRS code. Unlike most tax credits in the United States, the R&D tax credit can offset payroll taxes - in effect, cutting an unprofitable company’s burn rate by reducing the employer’s portion of social security taxes.

Not every startup will qualify for the R&D credit. It is important to talk to your accountant to make sure that you qualify.

How can a startup tell if they are eligible for the Form 6765?

The IRS has laid out several tests and outlines of qualifying and not qualifying expenses. The biggest item is to understand that all expenses filed under the Sixty-Seven Sixty-Five must be in the United States. Digging in:

What are “qualified” R&D activities?

The R&D credit is allowed for expenses paid or incurred for qualified research. But, what is considered “qualified research”? According to the IRS, qualified research for discovering information that is technological in nature and its application must be intended for use in developing a new or improved business component of the taxpayer.

The basic premise is that you can’t rehash the wheel so-to-speak. The research must be for something new. The IRS has a four part test to determine if your R&D expenses qualify:

- Qualified Purpose: The project must be specific and defined; no mindless tinkering allowed.

- Elimination of Uncertainty: The project must be legitimately advancing the “science” of your business or products, and your team must have attempted to eliminate uncertainty about the development process/project.

- Process of Experimentation: The company must document that it is using either a scientific method or trial and error process.

- Technical: The work must be grounded in the hard sciences like engineering, chemistry or biotechnology - note that “computer engineering” and “computer science” meets this test in many cases. This means that Software as a Service companies, for example, may be able to use this credit.

What are “unqualified” R&D Activities for 6765?

Not all expenses qualify. Check with your CPA to find out if your research activities qualify.

Here are some examples of expenses that generally are not allowed:

- Research conducted after the beginning of commercial production

- Research adapting an existing product or process to a particular customer’s need

- Duplication of an existing product or process

- Surveys or studies

- Research relating to certain internal-use computer software

- Research conducted outside the United States, Puerto Rico, or a U.S. possession

- Research in the social sciences, arts, or humanities

- Research funded by another person (or governmental entity)

Why should I file Form 6765?

Startups should file Form 6765 because they can get up to $250,000 in cash refunds quickly, even if the startup doesn’t have any revenue or is running at a loss. Want to see how much your startup could potentially get back with the R&D tax credit? Estimate your credit using our free calculator.

Who is eligible to file Form 6765 R&D Tax Credit?

Most startups with these qualities are eligible for the R&D Tax Credit. Most, but not all, of these traits are frequently seen for startups who can achieve the R&D Tax Credit:

- Delaware C-Corporation

- Venture backed

- Employs Engineers (Software, Mechanical, Chemical, or otherwise)

- Hires Domestic R&D Contractors

- Utilizes Amazon Web Services, or similar Cloud Computing Hosting Platform

- Purchases supplies and hardware components to build a new hardware product

- Has secured, or will secure patents

- Incorporated within 5 years

- Is within the Software, Hardware, Clean Energy, or Biotechnology Industries

- Generates less than $5M in revenue, or no revenue at all

What does Section 174 have to do with R&D tax credits?

IRS Code Section 174 and the R&D tax credit are two distinct provisions of the Internal Revenue Code that provide tax benefits for research and development (R&D) activities. While they both address R&D expenses, they serve different purposes and have different implications for taxpayers.

IRS Code Section 174

Since the Tax Cuts and Jobs Act, Section 174 forces taxpayers to amortize certain R&D expenses for income tax calculation purposes. This means that businesses spread these expenses out out over a period of time, instead of recognizing them right away.

R&D Tax Credit

The R&D tax credit is a credit against taxes owed, rather than a deduction. This means that it directly reduces the amount of taxes a business owes. The R&D tax credit is designed to encourage businesses to invest in R&D activities. This is actually a big deal, and it can push money losing startups into a position where they actually owe income tax, as if they were a profitable company!

Interaction between Section 174 and the R&D Tax Credit

The primary interaction between Section 174 and the R&D tax credit is that the expenses eligible for the R&D tax credit must also be expenses that are amortizable under Section 174. In other words, most businesses cannot claim the R&D tax credit for expenses that are not already deductible or amortizable.

In addition, there are some special rules that apply when both Section 174 and the R&D tax credit are applicable. This makes it important to work with a tax accountant who is very familiar with IRS rules, and who knows a lot about the preparation of your financial statements.

Implications for Taxpayers

The interaction between Section 174 and the R&D tax credit can have significant implications for taxpayers. Businesses should carefully consider both provisions when planning their R&D activities and tax strategies.

How is Form 6765 pronounced?

When speaking with your startup accountant, refer to Form 6765 as “Sixty-Seven, Sixty-Five.” In fact, most accountants refer to these forms with the first two numbers, followed by the second two numbers. For example, a Form 1040 is “Ten-Forty” and a Form 1120 is an “Eleven-Twenty”

How do I file Form 6765?

Form 6765 is filed as part of the 1120 package, also known as the Annual Income Tax Return for C-Corporations. Form 6765 is also accompanied by Forms 3800: General Business Credit within the 1120 package, and then also accompanied by Form 8974: Qualified Small Business Payroll Tax Credit for Increasing Research Activities, which is filed quarterly after the 1120 package has been filed.

When Do Startups Need to File a 6765 Form?

Form 6765 must be filed or extended by April 15th of every year in order to capture the cash-back payroll tax credit and collect up to $250,000. If the 1120 package is extended, you must file by Oct 15th of every year. If you fail to file timely, you lose out on the cash-back payroll tax credit to $250,000. Even if your startup is not generating revenue, or is unprofitable, you must file on time to collect the cash-back payroll tax credit of up to $250,000. Note that the Inflation Reduction Act will increase the maximum credit from $250,000 to half a million dollars for the tax year 2023.

Can I file form 6765 myself, or have an R&D software program file form 6765 for me?

Yes, you can file Form 6765 yourself by completing the Form manually or completing it through a software provider such as Intuit TurboTax. Keep in mind that you will need to complete the entire 1120 package as well. Realize that this form is likely the number one reason unprofitable, VC-backed companies are audited by the IRS - and that major corporations M&A teams will likely conduct due diligence on any tax credits so that they do not assume any unexpected liabilities. Beware of the following possible issues if you DIY or use a software solution:

- Overstated Form 6765: with a potential for hundreds in thousands of dollars in cash back, it can be easy to pile on “qualified” expenses that the IRS doesn’t truly consider to be qualified R&D. For example, we often see Founders mistakenly include employees who are engaged in Quality Assurance with the R&D process, but this activity is strictly forbidden from being included in the R&D calculation. There’s a myriad of other qualifications. The more cash back you are getting from the IRS, the more ripe you are targeted for an audit. You are, after all, taking money from them - which is arguably worse than understating your taxes. If the audit demands that you pay back the money and your startup has either gone out of business or doesn’t have the money, YOU the founder are liable and will have to pay the tax bill.

- Understated Form 6765: there’s also the possibility of understating the amount of R&D that your company engaged in. In this case, you could be leaving tens of thousands in cash, every year, unclaimed.

In sum, we highly recommend that you work with a tax CPA to file both your 1120 and your Form 6765 R&D Tax Credit to ensure that your startup claims all reasonable and qualified R&D expenses in order to achieve up to $250,000 in cash back every year. And note that the maximum amount cash back is doubling, but for the tax year 2023.

Finally, if you do choose to file Form 6765 and 1120 yourself, the work does not stop there. You will need to file and monitor Form 8974: Qualified Small Business Payroll Tax Credit for Increasing Research Activities, every quarter with your payroll provider until the full credit is claimed, which often takes 5 quarters. This lead us to another problem that we see every year:

What if my payroll provider does not get my company the credit due under Form 8974?

We regularly see payroll providers who make mistakes getting the credit to their startup clients. This error could cost your company hundreds of thousands of dollars! When we prepare the Form 6765 for our bookkeeping clients, we help make sure that they get the credit that they are owed. If you DIY this form, make sure you talk to your payroll provider to understand what you need to get to them and when you’ll benefit from the credit.

Should a CPA accept a non-CPA prepared Form 6765?

As one of the leading CPAs serving VC-backed startups, we prepare hundreds of corporate tax returns every year - and we do not accept outside, non-CPA prepared Form 6765’s for several specific reasons:

- Liability - payroll tax credits are a leading cause of audits for cash-burning startups. It’s the tax preparer who bears this risk, so using a non-CPA prepared dramatically increases the risk of the return. We do not recommend our fellow business CPAs take on the risk of outside tax credit work.

- Cost - any CPA worth their salt will want to dig in on any outside 6765. That increases the cost of preparing a return. If a client asks us to take a look at a third-party 6765 - in particular ones prepared by “automated” systems, we regularly find significant errors. The work to untangle these errors and keep our clients out of trouble is not worth the effort or risk, so we prepare these forms for our clients ourselves.

- Timing - the Form 6765 has to be filed with the Form 1120. We can’t delay the filing of our clients’ Form 1120’s. It’s not worth the risk of delaying or missing deadlines, when we know we can prepare this form on time, usually at a lower cost.

Caveat: The information on this page intended as general guidance and it doesn’t substitute the need to work with a professional. It’s also a high level overview and is in no way complete. Your company is unique; contact Kruze Consulting.

Form 6765 Instructions

Instructions on filling out Form 6765:

- Determine if your startup is eligible

- Calculate your “qualified R&D activities”

- Determine if you need to do Section A or B - do one

- Do Section C

- Section D is if you are going to get the payroll offset - which most VC-backed startups will do

- Attach to your tax return

- File and monitor Form 8974

Remember, payroll providers mess this up all the time, so make sure you are monitoring your payroll taxes to get the credit! Working with a CPA like Kruze can help you avoid costly mistakes.

Step-by-step instructions: Form 6765

IRS Form 6765, Credit for Increasing Research Activities, allows businesses to claim the Research and Development (R&D) tax credit. This credit is available to startups and other businesses that engage in qualifying research activities. You can use our R&D tax calculator to see how much your credits might be worth.

Please note that the IRS pays close attention to R&D claims, and frequently audits them. We strongly recommend that you rely on a startup tax professional who can make sure your claim is accurate and provide your startup with support if you are audited.

Below are step-by-step guide Form 6765 instructions.

Step 1: Download Form 6765

- Visit the IRS website and download the latest version of Form 6765.

- Make sure you are working with the correct tax year version.

- Download the Form 6765 instructions.

Step 2: Identify if Your Startup Qualifies

Start by confirming that your startup qualifies for the R&D credit. The work must meet the IRS’s Four-Part Test:

- Qualified purpose – The activity must aim to create a new or improved product, process, or software.

- Elimination of uncertainty – The project must attempt to resolve technical uncertainty.

- Process of experimentation – The company must undertake a systematic process, including modeling, simulation, or trial and error.

- Technological in nature – The work must rely on hard sciences (e.g., engineering, computer science, biology).

Step 3: Gather Required Information

- Qualified research expenses (QREs): These include wages, supplies, contract research costs, and any lease costs for computers used for qualified research.

- Base amount: The base amount refers to the company’s past R&D efforts used to calculate the incremental increase. For startups with less than three years of history, the base amount calculation may differ. The IRS provides specific guidelines for these cases.

- Gross receipts: Your company’s revenue, used in calculating the base amount and credit.

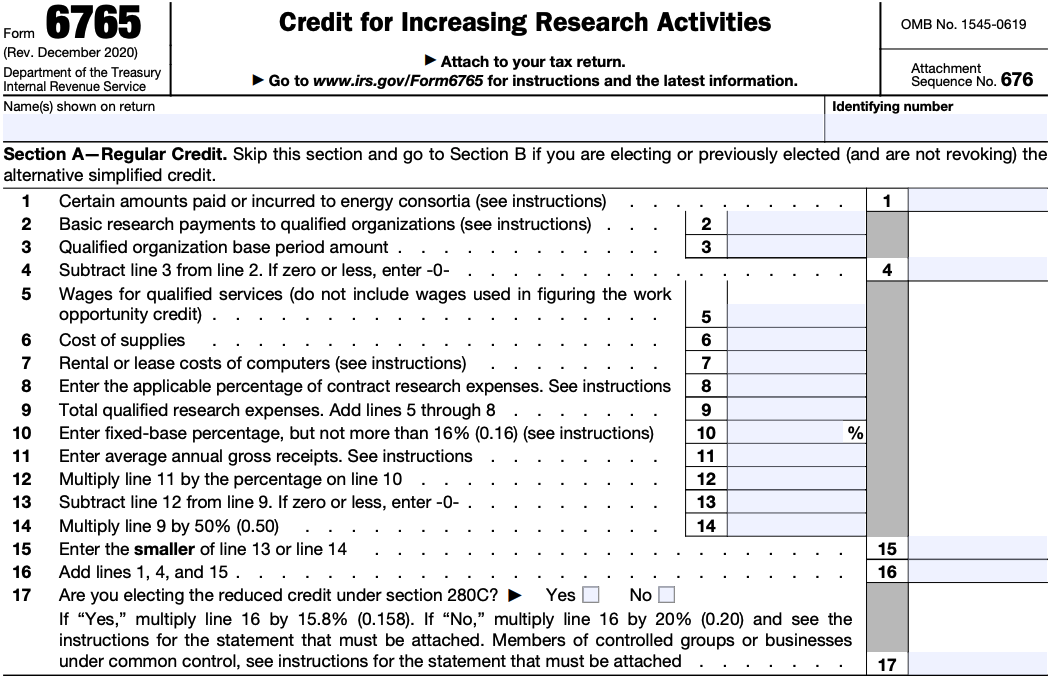

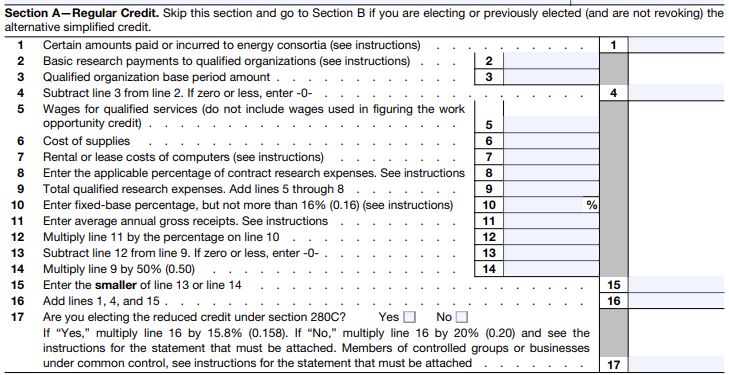

Step 4: Fill Out Section A - Regular Credit

Please note that lines 7-11 may not be applicable to startups that don’t have the required historical data. New businesses may use a fixed-base percentage of 3% for the first five tax years.

- Enter amounts paid for energy research on line 1.

- Fill in basic research payments on line 2 if applicable.

- Calculate and enter the base period amount on line 3.

- Complete lines 4-6 as instructed on the form.

- Enter computer rental costs for qualified research on line 7.

- On line 8, enter amounts paid to others for qualified research, applying the appropriate percentages (100%, 75%, or 65%).

- Calculate your fixed-base percentage for line 10 based on whether you’re an existing or start-up company.

- Enter average annual gross receipts on line 11.

- Complete the remaining calculations as directed on the form.

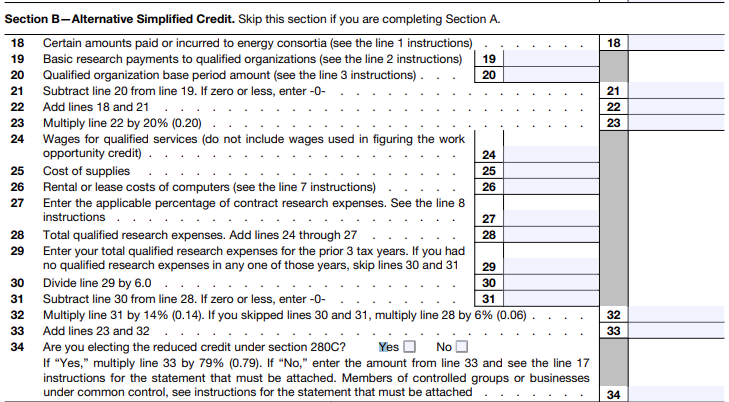

Step 5: Fill Out Section B - Alternative Simplified Credit (ASC)

Startups must choose between the regular credit method and the Alternative Simplified Credit method. Complete this section if you’re using the ASC instead of the regular method.

- Enter qualified research expenses for the current year on line 24.

- Calculate and enter the average qualified research expenses for the prior 3 tax years on line 29.

- Complete the remaining calculations as directed on the form.

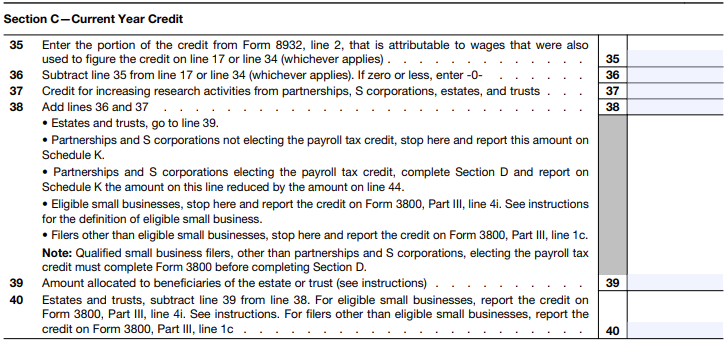

Step 6: Fill Out Section C - Current Year Credit

- If applicable, enter any credit for employer differential wage payments on line 35.

- Include any research credits from pass-through entities on line 37.

- For estates and trusts, allocate the credit between the entity and beneficiaries on line 39.

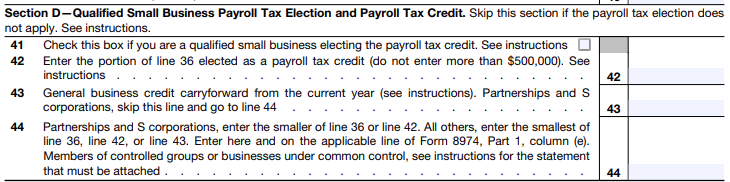

Step 7: Fill Out Section D - Eligible Small Business

This section applies to qualified small businesses (QSBs) that want to use the credit to offset payroll taxes instead of income tax.

- Complete this section only if making the payroll tax election.

- Check the box on line 41 if you’re a qualified small business electing to claim a portion of the credit as a payroll tax credit.

- Enter the portion of the credit claimed as a payroll tax credit on line 42 (max $500,000).

- Use the provided worksheet to calculate the general business credit carryforward on line 43.

- Enter the final payroll tax credit amount on line 44 and transfer this to Form 8974.

Step 8: Attach to Your Tax Return

- Attach Form 6765 to your company’s tax return (e.g., Form 1120 for corporations).

- Ensure all supporting documentation, such as payroll records, supply invoices, and contracts related to research expenses, is available in case of an IRS audit.

Step 9: File the Form

- File electronically or mail it with your tax return by the applicable tax deadline.

Step 10: Monitor Payroll Offset (If Applicable)

If you opted to apply the R&D credit toward payroll taxes, file Form 8974 (Qualified Small Business Payroll Tax Credit for Increasing Research Activities) with your quarterly payroll tax return (e.g., Form 941). This reduces the employer portion of Social Security tax owed.

Tips for Filling Out Form 6765

- Consult a tax professional: The R&D credit can be complex, and a professional familiar with startup tax incentives can help maximize the credit.

- Document your research activities: Keep detailed records of the time, labor, and materials used in your research projects. You should document your activities as they happen (contemporaneously) which improves accuracy and strengthens your claim in case of an IRS audit.

- Be consistent. Make sure the research expenses you claim match those reported on other tax forms and financial statements.

- Show clear connections. Make sure that you demonstrate a clear connection between any claimed expenses and the qualified research activities.

- State R&D credits. Many states offer their own R&D tax credits, like the California R&D tax credit. These states may have different rules, but state credits can often be claimed in addition to the federal credit.

- Credit carryforward. Unused R&D credits can be carried forward for up to 20 years, which can help startups that don’t have tax liabilities in their early years.

Instructions for Form 6765

Caveat: The information on this website about Form 6765 and other tax forms and information is intended as general guidance/for informational purposes only, and was created as of November 17, 2020 and may not be up to date. Only use the official Form 6765 and instructions from the IRS’ official website for this and other tax matters, which is typically accessible at https://www.irs.gov/forms-instructions. The information provided on this URL does NOT substitute the need to work with a professional. Your company is unique; contact Kruze Consulting.

Form 6765 (Rev. December 2019) Department of the Treasury Internal Revenue Service

Credit for Increasing Research Activities

▶ Attach to your tax return.

▶ Go to www.irs.gov/Form6765 for instructions and the latest information.

OMB No. 1545-0619

Attachment Sequence No. 81

Section A—Regular Credit. Skip this section and go to Section B if you are electing or previously elected (and are not revoking) the alternative simplified credit.

If “Yes,” multiply line 16 by 15.8% (0.158). If “No,” multiply line 16 by 20% (0.20) and see the instructions for the statement that must be attached. Members of controlled groups or businesses under common control, see instructions for the statement that must be attached

Section B—Alternative Simplified Credit. Skip this section if you are completing Section A.

If “Yes,” multiply line 33 by 79% (0.79). If “No,” enter the amount from line 33 and see the line 17 instructions for the statement that must be attached. Members of controlled groups or businesses under common control, see instructions for the statement that must be attached .

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 6765 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Section C—Current Year Credit

- Estates and trusts, go to line 39.

- Partnerships and S corporations not electing the payroll tax credit, stop here and report this amount on Schedule K.

- Partnerships and S corporations electing the payroll tax credit, complete Section D and report on Schedule K the amount on this line reduced by the amount on line 44.

- Eligible small businesses, stop here and report the credit on Form 3800, Part III, line 4i. See instructions for the definition of eligible small business.

- Filers other than eligible small businesses, stop here and report the credit on Form 3800, Part III, line 1c.

Note: Qualified small business filers, other than partnerships and S corporations, electing the payroll tax credit must complete Form 3800 before completing Section D.

Section D—Qualified Small Business Payroll Tax Election and Payroll Tax Credit. Skip this section if the payroll tax election does not apply. See instructions.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 6765 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.