FORM 5471: EVERYTHING YOU NEED TO KNOW

Form 5471: Ownership in foreign corporations

One tax requirement that’s complicated and hard to understand is for US citizens and residents who have ownership in a foreign corporation. These people are required to file IRS Form 5471, Information Return of US Persons with Respect to Certain Foreign Corporations.

What is Form 5471 and Who Needs to File?

Form 5471 is an information return, rather than a tax return. This form is designed to provide the IRS with a record of U.S. citizens, residents, and entities that have significant ownership or control in foreign corporations. It’s similar to Form 1120, the US corporate income tax return, and requires much of the same information. It differs from Form 5472, which is intended for foreign corporations that do business in the US, or for US corporations that are at least 25 percent foreign owned.

In general, any US citizen, corporation, partnership, trust, or estate that owns at least 10 percent of the shares of a foreign corporation needs to file Form 5471 with their Federal income tax return. If you own more than 50 percent of the shares of the foreign corporation, you may be required to file additional schedules and statements. If you’re not sure if you are required to file, the IRS has published detailed qualifications. The qualifications for Form 5471 are extremely convoluted, so if you think you qualify, it’s a good idea to consult your accountant.

Who Should File a Form 5471

You may need to file Form 5471 if you are a U.S. person who:

- Owns at least 10% of the shares of a foreign corporation

- Is an officer or director of a foreign corporation where a U.S. person has acquired a substantial ownership interest

- Owns more than 50% of the shares of a foreign corporation

- Meets other specific criteria outlined by the IRS

Remember to work with a qualified CPA, as every startup’s / businesses’ situation is unique.

What is a 5471 Form Used For?

Form 5471 serves several important purposes for the IRS and U.S. taxpayers:

- Reporting ownership: It provides detailed information about U.S. persons’ ownership in foreign corporations.

- Tracking foreign income: The form helps the IRS monitor income earned through foreign corporations.

- Ensuring compliance: It allows the IRS to verify compliance with international tax laws and regulations.

- Disclosing corporate structure: Form 5471 reveals the organizational structure of foreign corporations with U.S. ownership.

One crucial component of Form 5471 is Schedule O, which is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. This schedule provides the IRS with valuable information about changes in ownership and corporate structure.

Unlike IRS Form Schedule K, which is part of the basic corporate tax return and covers general company information such as ownership changes, business activities, investments in other corporations, and participation in reportable transactions, Form 5471 is specifically focused on foreign corporation reporting requirements.

Practical Advice - What Should You Do?

- Have a Bias Toward Filing: If you have any doubt about whether to file, do it. The $10,000 penalty is too steep to risk.

- Seek Professional Help: Due to the intricacy and potential retroactivity, it’s advisable to consult with professionals experienced in international taxation issues. Proper documentation and professional advice can be your best defense.

- Appeal if Necessary: If penalties are assessed, you must act quickly to file an appeal. Knowledge of the correct procedures and timelines is crucial.

- Be Prepared for Audit: As Form 5471 effectively opens up your entire tax return for scrutiny, ensure that all other aspects of your return are in order.

What if you don’t file?

If you are required to file Form 5471 and you don’t file, you can face a $10,000 penalty for each annual accounting period of the foreign corporation. If the IRS notifies you that you’re required to file Form 5471 and you don’t file one within 90 days, you could incur a penalty of $60,000.

Understanding the Purpose of Form 5471

What is a 5471 Form Used For?

Form 5471 serves several important purposes for the IRS and U.S. taxpayers:

- Reporting ownership: It provides detailed information about U.S. persons’ ownership in foreign corporations.

- Tracking foreign income: The form helps the IRS monitor income earned through foreign corporations.

- Ensuring compliance: It allows the IRS to verify compliance with international tax laws and regulations.

- Disclosing corporate structure: Form 5471 reveals the organizational structure of foreign corporations with U.S. ownership.

One crucial component of Form 5471 is Schedule O, which is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. This schedule provides the IRS with valuable information about changes in ownership and corporate structure.

Key Components of Form 5471

Form 5471 consists of several schedules, each serving a specific purpose in reporting information about foreign corporations. Some of the most important schedules include:

- Schedule A (Stock of the Foreign Corporation)

- Schedule B (Shareholders of Foreign Corporation)

- Schedule C (Income Statement)

- Schedule F (Balance Sheet)

- Schedule G (Other Information)

- Schedule I (Summary of Shareholder’s Income)

- Schedule O (Organization or Reorganization of Foreign Corporation)

Each of these schedules requires detailed information about the foreign corporation’s financial status, ownership structure, and transactions. Accurately completing these schedules is crucial for compliance with IRS regulations.

Filing Requirements and Deadlines

Form 5471 is not a standalone return; it must be filed with the U.S. person’s tax return. This means that the deadline for filing Form 5471 coincides with the deadline for your personal or business tax return, including any extensions.

For most individual taxpayers, this means Form 5471 is due on April 15th of each year, unless an extension is granted. For corporations and partnerships, the deadline may vary depending on their fiscal year and any extensions filed.

It’s crucial to note that even if you have a dormant foreign corporation, you may still be required to file Form 5471. In such cases, taxpayers can take advantage of a summary filing procedure outlined in Rev. Proc. 92-70.

Guide To Filling Out Form 5471

Form 5471 is a complex document that requires detailed information about a foreign corporation’s business activities, shareholders, and financial status. Completing it properly means gathering extensive data and navigating through the lengthy instructions, which can be quite challenging. We strongly recommend that you work with an experienced tax preparer.

Here are high-level instructions on how to fill out Form 5471.

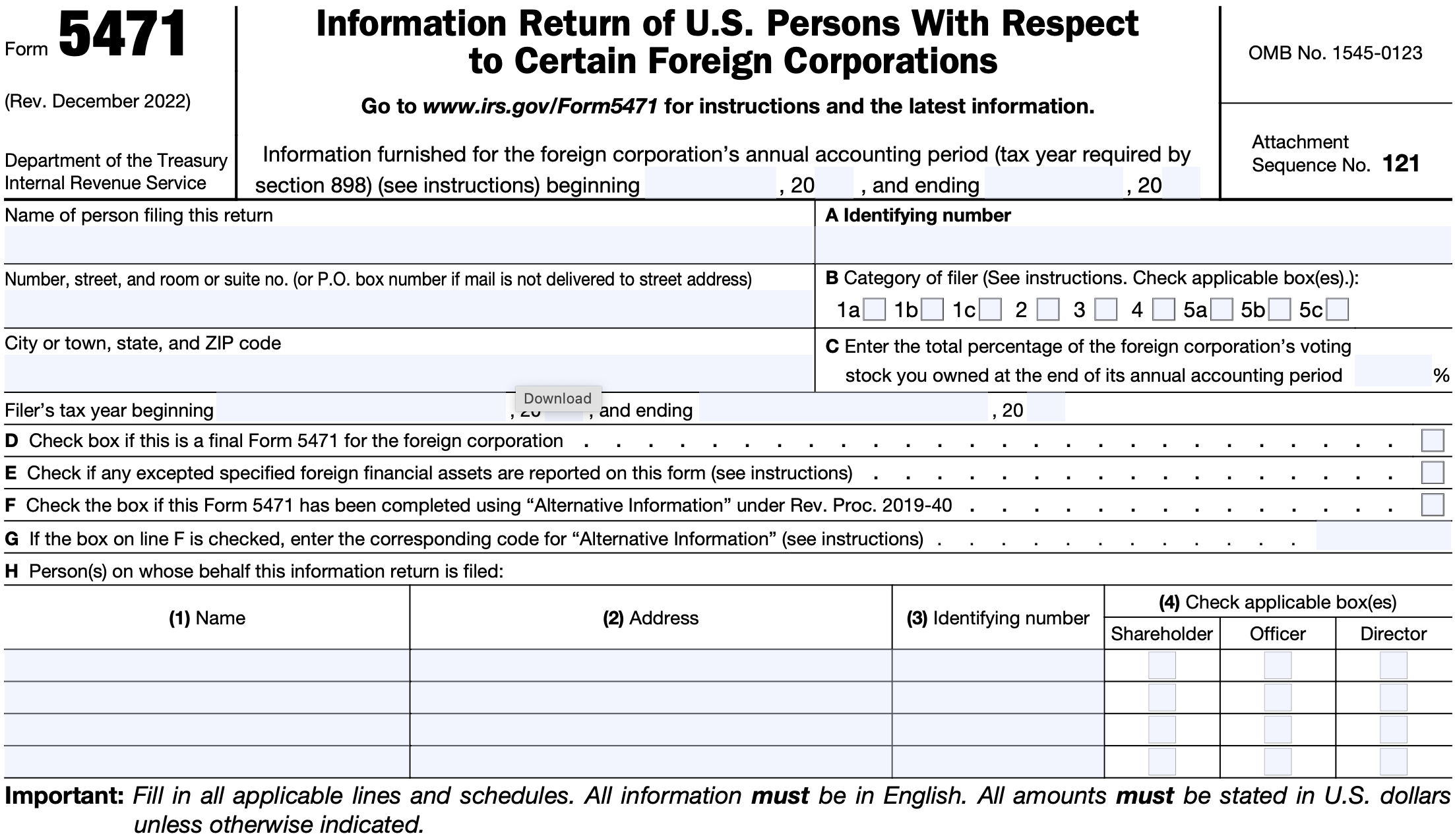

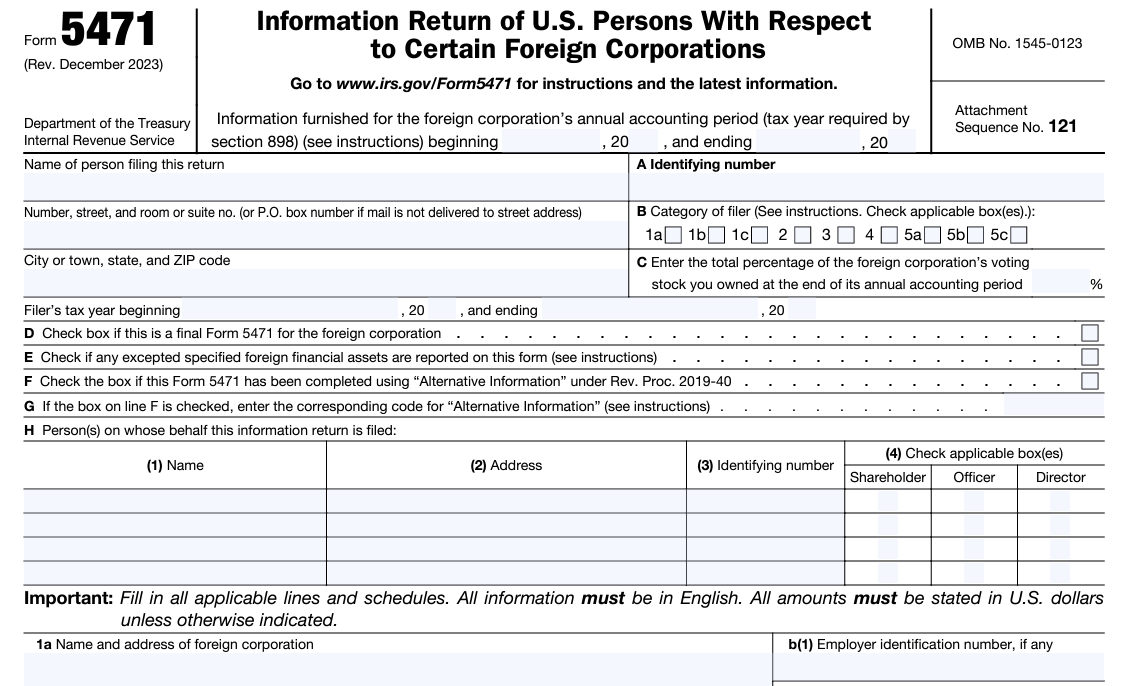

Step 1: Top Section: Name, Address, etc.

- Name of Person Filing: Enter the name of the U.S. person responsible for filing, or the U.S. parent company in the case of a consolidated return. If the name changed in the last three years, include the previous name in parentheses.

- Address: Provide a complete address, including suite or unit number. Use a P.O. box if that is where mail is delivered, and follow international address formats if it’s a foreign address.

- Identifying Number (Item A): Use the Social Security Number (SSN) for individuals or the Employer Identification Number (EIN) for businesses. For consolidated returns, enter the EIN of the common parent.

- Category of Filer (Item B): Indicate the filer’s category by checking the appropriate boxes. If multiple categories apply, check all that fit.

- Percentage of Voting Stock (Item C): Report the total percentage of voting stock owned directly, indirectly, or constructively by the filer.

- Final Year (Item D): Check this box if the foreign corporation is no longer considered a corporation for tax purposes due to liquidation, reorganization, or a change to a disregarded entity.

- Excepted Foreign Assets (Item E): Check if any excepted specified foreign financial assets are reported, which eliminates the need to report them on Form 8938.

- Alternative Information (Item F): Check if using alternative information under Rev. Proc. 2019-40, allows for simplified reporting in certain cases.

- Alternative Information Code (Item G): If alternative information is used, enter the appropriate code indicating the basis of financial data (e.g., U.S. GAAP, IFRS, or local accounting standards).

- Person(s) on Whose Behalf Return Is Filed (Item H): Indicate if filing on behalf of multiple U.S. persons with the same filing requirements. Provide details on who the information pertains to and ensure separate forms or worksheets are sent as needed.

Step 2: Schedule A - Stock of the Foreign Corporation

Schedule A of Form 5471 is used to report details about a foreign corporation’s voting stock. Filers need to list the number of shares for each class of stock owned at the beginning and end of the accounting period, as well as any changes during that period. It’s important to get stock ownership percentages right, as accurate reporting is key to staying compliant.

Step 2: Schedule B - Shareholders of Foreign Corporation

Part I: U.S. Shareholders of Foreign Corporation

Schedule B, Part I of Form 5471 is required for Category 3 and 4 filers to report U.S. persons who, at any time during the accounting period, directly or indirectly owned 10% or more of the voting power or total value of the foreign corporation’s stock.

If a filer is both a Category 3 and Category 5 filer (as a U.S. shareholder under section 953(c)(1)(A)), they must also report U.S. persons who owned any shares on the last day of the foreign corporation’s tax year. In column (e), filers should list each shareholder’s share of the foreign corporation’s subpart F income.

Part II: Direct Shareholders of Foreign Corporation

Part II of Form 5471 is required for Category 1a, 1c, 3, 4, 5a, and 5c filers to report the direct shareholders of a foreign corporation. If a controlled foreign corporation (CFC) is owned by a foreign disregarded entity (FDE), the filer should include information about both the FDE and its regarded entity owner, with the owner’s name in parentheses after the FDE’s name.

For multiple regarded entity owners, list each on a separate line with the necessary details. Category 4 filers must report all direct owners of the CFC, while Category 1a, 3, and 5a filers should list owners of the specified foreign corporation (SFC) or CFC through which they hold indirect ownership. Category 1c and 5c filers need to report the owners from whom they are attributed ownership of the SFC or CFC. If the filer is a direct owner, they should include their ownership information.

Step 3: Schedule C - Income Statement

Schedule C of Form 5471 requires an income statement for the foreign corporation, including details on gross receipts, sales, cost of goods sold, other income, and deductions. This information must be prepared in the corporation’s functional currency following U.S. Generally Accepted Accounting Principles (GAAP), so familiarity with both foreign currency and U.S. accounting standards is essential.

Key requirements for Schedule C:

- Currency and GAAP Compliance: Report all amounts in the foreign corporation’s functional currency according to U.S. GAAP, and translate figures using U.S. GAAP translation rules.

- Hyperinflationary Environments: If the foreign corporation uses DASTM under Regulations section 1.985-3, report local hyperinflationary currency amounts and translate them into U.S. dollars per U.S. GAAP rules. Differences should be addressed on Schedule H.

- Foreign Currency Gains/Losses (Line 8): Report both unrealized and realized gains or losses, including those from comprehensive income.

- Transactional Taxes (Line 16): Enter taxes excluding income tax expenses, which should be reported separately on line 21.

- Unusual or Infrequent Items (Line 20): Include items defined by U.S. GAAP, such as those outlined in FASB ASC Topic 220.

- Income Tax Expense (Line 21): Report current and deferred income tax expenses, and adjust the net income on Line 22 based on these amounts.

- Comprehensive Income (Lines 23 and 24): Include foreign currency translation adjustments, other comprehensive income, and related tax benefits.

- Accounting for Tax Differences: Any differences between functional currency tax expenses and U.S. E&P tax amounts should be reconciled on Schedule H.

Step 4: Schedule F - Balance Sheet

Schedule F of Form 5471 requires a detailed balance sheet for the foreign corporation, including assets, liabilities, and shareholders’ equity, prepared in the corporation’s functional currency using U.S. GAAP. The information must then be translated into U.S. dollars following GAAP translation rules, or, if the foreign corporation uses DASTM, it should be translated according to specific tax regulations.

Filers need to report derivatives separately without netting, including both short-term and long-term positions. Preparing this balance sheet can be time-consuming, but it’s a valuable process that helps uncover essential financial details and identifies potential issues early on.

Step 5: Schedule G - Other Information

Schedule G of Form 5471 collects a range of additional information about the foreign corporation, including details on its principal business activity, functional currency, U.S. income tax paid or accrued, distributions made, and any transactions with related parties. Despite its importance, Schedule G is sometimes overlooked, which can lead to missed insights into the corporation’s operations and potential tax issues. Even a single reportable transaction on this schedule can trigger a full audit, making it essential to complete it carefully and accurately.

Step 5: Schedule I - Summary of Shareholder’s Income From Foreign Corporation

Schedule I of Form 5471 provides a summary of the U.S. shareholder’s income from the foreign corporation, including their pro rata share of income, deductions, and credits. This schedule consolidates the information gathered in previous sections to determine the amount of income that must be reported on the shareholder’s U.S. tax return, making it crucial for calculating the correct tax liability. Accurate completion is essential, as this is where all the effort from earlier schedules comes together. In some cases, filers may use alternative information under specific guidelines to determine certain amounts.

Form 5471 Category of Filers

Form 5471 has different categories of filers, each with specific criteria based on their involvement with foreign corporations. Here’s a quick overview of the main categories:

- Category 1 Filers: U.S. shareholders of a foreign corporation that was a specified foreign corporation (SFC) under Section 965. This includes shareholders who owned stock on the last day the corporation was classified as an SFC.

- Category 2 Filers: U.S. citizens or residents who are officers or directors of a foreign corporation in which a U.S. person has acquired a 10% or greater stock ownership.

- Category 3 Filers: U.S. persons who acquire, increase, or decrease their ownership in a foreign corporation, leading to 10% or greater stock ownership, or who become U.S. persons while owning 10% or more of the foreign corporation’s stock.

- Category 4 Filers: U.S. persons who control a foreign corporation, defined as owning more than 50% of the voting power or value of the stock, either directly or indirectly.

- Category 5 Filers: U.S. shareholders of a controlled foreign corporation (CFC) at any time during the foreign corporation’s tax year who owned stock on the last day it was a CFC.

Form 5471 Schedules Explained

Form 5471 is a detailed form that includes 12 different schedules. Depending on your situation, you may need to fill out some or all of them. These schedules help provide the extra information the IRS needs.

- Form 5471 Schedule A – Stock of the Foreign Corporation

- Form 5471 Schedule B – US Shareholders of Foreign Corporations

- Form 5471 Schedule C – Income Statement

- Form 5471 Schedule E – Income, War Profits, and Excess Profits: Taxes Paid or Accrued

- Form 5471 Schedule F – Balance Sheet

- Form 5471 Schedule G – Other Information

- Form 5471 Schedule H – Current Earnings and Profits

- Form 5471 Schedule I – Summary of Shareholder’s Income from Foreign Corporation

- Form 5471 Schedule J – Accumulated Earnings and Profits of Controlled Foreign Corporations

- Form 5471 Schedule M – Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons

- Form 5471 Schedule O – Organization or Reorganization of Foreign Corporation, and Acquisitions and Dispositions of its Stock

- Form 5471 Schedule Q – Report of Controlled Foreign Corporation income by CFC income groups

- Form 5471 Schedule R – Distributions From a Foreign Corporation

The IRS website has a table that provides the requirements by category:

Guide To Filling Out Form 5471 Schedule R

Schedule R of Form 5471 is used by foreign corporations to report information on distributions made to their U.S. shareholders. It is specifically required for Category 4 filers, who are U.S. persons with control over a foreign corporation (owning more than 50%), and Category 5a filers, who are U.S. shareholders with stock in a controlled foreign corporation (CFC).

The schedule consists of four columns to capture key details about these distributions, and it must be submitted along with Form 5471.

Additionally, an income statement in the foreign corporation’s functional currency is needed to complete Schedule R. The form is due on the same date as the filer’s annual tax return, ensuring compliance with sections 245A, 959, and 986(c) of the Internal Revenue Code.

Schedule R of Form 5471 can be confusing for small business owners to navigate, so we strongly recommend that you work with an experienced tax preparer.

Here are high-level instructions on how to fill out each of the four columns of Schedule R, which you can find on the IRS website.

Step 1: Column A - Description of distribution

In Column (a) of Schedule R, filers must provide details on whether distributions from a foreign corporation were cash or non-cash, and whether they were taxable or nontaxable, clearly identifying them using relevant tax code sections. Here are the key points to remember:

- Identify Distribution Type: Specify if the distribution was cash or non-cash and if it was taxable or nontaxable. Use the appropriate code sections to determine the tax treatment (e.g., “taxable cash dividend eligible for dividends received deduction under Section 245A” or “nontaxable cash distribution of previously taxed earnings and profits (PTEP)”).

- Separate Reporting for Mixed Distributions: If a distribution is partially taxable and partially nontaxable, or involves different tax treatments under various code sections, report each part on a separate row.

- Example of Mixed Reporting: For instance, a $100 cash distribution might be broken down as follows:

- $30 as a nontaxable distribution of PTEP under Section 959(a)

- $15 as a taxable dividend eligible for a deduction under Section 245A

- $25 as a taxable dividend under Section 301(c)(1)

- $10 as a nontaxable distribution applied against basis under Section 301(c)(2)

- $20 as a taxable gain treated as a sale or exchange under Section 301(c)(3)

- Non-Cash Distributions: Attach a statement for non-cash distributions, including details on both the tax basis and fair market value.

Step 2: Column B - Date of distribution

In Column (b) of Schedule R, filers must enter the exact date of each distribution received from the foreign corporation, using the format MM-DD-YYYY. This means listing the month, day, and year, such as “06-30-2023” for a distribution made on June 30, 2023.

Step 3: Column C - Amount of distribution in foreign corporation’s functional currency

In Column (c) of Schedule R, filers must report the total amount of a distribution received from a foreign corporation, expressed in the corporation’s functional currency. This includes any cash payments and the fair market value (FMV) of property transferred to the shareholder. However, the reported amount can be reduced, but not below zero, by certain liabilities.

Filers also need to indicate whether the distribution was made from current or accumulated earnings and profits (E&P) and must disclose any currency gains or losses if previously taxed earnings and profits (PTEP) were distributed, as required by Section 986(c).

The distribution amount can be adjusted by the following liabilities:

- Liabilities Assumed: Any liability of the corporation that the shareholder assumes as part of the distribution.

- Property-Related Liabilities: Any liability attached to the property both immediately before and after the distribution.

Step 4: Column D - Amount of E&P distribution in foreign corporation’s functional currency

Column (d) of Schedule R is used to report distributions from a foreign corporation that count as earnings and profits (E&P) in the company’s functional currency. Typically, distributions are considered E&P, starting with previously taxed earnings and profits (PTEP) and then any remaining balances under section 959(c)(3). Only amounts classified as E&P should be listed here.

If PTEP is part of the distribution, any foreign currency gains or losses must be reported on Form 5471, Schedule I. Corporate U.S. shareholders should include these gains or losses as “Other income” on their corporate tax return, while non-corporate shareholders should report them on Schedule 1 (Form 1040). These details also need to be reflected on related sections of Schedule J and Schedule P.

Guide To Filling Out Form 5471 Schedule P

Schedule P of Form 5471 is used by U.S. shareholders to report previously taxed earnings and profits (PTEP) from a controlled foreign corporation (CFC). PTEP refers to the earnings of a foreign corporation that has already been taxed in the U.S., and this schedule helps track those amounts.

Part I of Schedule P requires reporting PTEP in the CFC’s functional currency, while Part II converts this information into U.S. dollars. It also applies to certain specified foreign corporations (SFCs) treated as CFCs for limited purposes under Section 965(e)(2) of the tax code.

Completing Schedule P can be complex, and whether a shareholder must fill it out depends on their specific filing category under Form 5471. We strongly recommend that you work with an experienced tax preparer.

Here are high-level instructions on how to fill out part of Schedule P, which you can find on the IRS website.

Step 1: Lines a and b

Schedule P begins by instructing the preparer to complete lines a and b, which involve identifying the category of income being reported. Line a requires the preparer to enter the appropriate income category code, as outlined in the instructions for IRS Form 1118. Form 1118 identifies six categories of foreign source income, each with a specific code, which must be used on Schedule P.

Preparers need to complete a separate Schedule P for each category of income, excluding foreign branch income. If the code “901j” is used on line a, indicating income from a sanctioned country, line b must include the two-letter country code for that nation, based on the list available on the IRS website.

The preparer can choose from the relevant income categories and codes listed below.

Source: Instructions for Form 1118

Step 2: Previously Taxed E&P in Functional Currency

Part I of Schedule P on Form 5471 tracks the accumulated earnings and profits (E&P) of a controlled foreign corporation (CFC) shareholder in the foreign corporation’s functional currency.

Pre-1987 PTEP amounts should be converted using specific rules and added to post-1986 amounts. To complete this section, it’s important to understand how Section 959 orders PTEP distributions: starting with investments in U.S. property, then subpart F income, and finally general E&P.

Recent IRS regulations require CFCs to maintain annual accounts for PTEP, organizing them into specific groups to ensure proper tracking and reporting.

Step 2: Previously Taxed E&P in U.S. Dollars

Part II of Schedule P requires the CFC shareholder to report the same information from Part I but in U.S. dollars. The U.S. shareholder’s dollar basis in PTEP equals the amount of E&P previously included in their gross income, which helps determine any foreign currency gain or loss under Section 986(c). Columns (a) through (k) track the opening balance, current year changes, and closing balance of PTEP in the U.S. shareholder’s accounts. If there are discrepancies between last year’s ending balance and the expected balance, these should be reported on line 1b, with an explanation attached.

Form 5471 and Startup Taxes

For startup founders and investors dealing with international business structures, understanding Form 5471 is an important part of getting startup taxes right. Many startups expand globally or establish foreign subsidiaries, which can trigger Form 5471 filing requirements. Failing to comply with these requirements can lead to significant penalties and complications in future funding rounds or exit strategies.

If your startup has any foreign corporate interests, it’s essential to:

- Identify all potential Form 5471 filing obligations

- Implement systems to track ownership changes and financial information

- Work with tax professionals experienced in international startup taxation

- Consider the tax implications of your global business structure

Talk to your accountant

Form 5471 is very complicated and includes 12 schedules which you may or may not need to complete. Your accountant at Kruze Consulting can help guide you through this process. For more information, contact us.

Form 5471 (Rev. December 2022) Department of the Treasury Internal Revenue Service

Information Return of U.S. Persons With Respect to Certain Foreign Corporations

Information furnished for the foreign corporation’s annual accounting period (tax year required by section 898) (see instructions) beginning _ _ _ _ _ _ _ _, 20__, ending _ _ _ _ _ _ _ _ , 20_ _

▶ Go to www.irs.gov/Form5471 for instructions and the latest information.

OMB No. 1545-0123

Attachment Sequence No. 121

| (1) Name | (2) Address | (3) Identifying number | (4) Check applicable box(es) | ||

| Shareholder | Officer | Director | |||

| ▢ | ▢ | ▢ | |||

| ▢ | ▢ | ▢ | |||

| ▢ | ▢ | ▢ | |||

|

1a

Name and address of foreign corporation

|

b(1) Employer identification number, if any

|

|

b(2) Reference ID number (see instructions)

|

|

|

c Country under whose laws incorporated

|

|

a Name, address, and identifying number of branch office or agent (if any) in the United States

|

b If a U.S. income tax return was filed, enter: | |

| (i) Taxable income or (loss) | (ii) U.S. income tax paid (after all credits) | |

|

c

Name and address of foreign corporation’s statutory or resident agent in country

of incorporation

|

b

Name and address (including corporate department, if applicable) of person (or

persons) with custody of the books and records of the foreign corporation, and

the location of such books and records, if different

|

| (a) Description of each class of stock | (b) Number of shares issued and outstanding | |

| (i) Beginning of annual accounting period | (ii) End of annual accounting period | |

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 5471 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

| (a) Name, address, and identifying number of shareholder | (b) Description of each class of stock held by shareholder. Note: This description should match the corresponding description entered in Schedule A, column (a). | (c) Number of shares held at beginning of annual accounting period | (d) Number of shares held at end of annual accounting period | (e) Pro rata share of subpart F income (enter as a percentage) |

| (a) Name, address, and identifying number of shareholder. Also, include country of incorporation or formation, if applicable. | (b) Description of each class of stock held by shareholder. Note: This description should match the corresponding description entered in Schedule A, column (a). | (c) Number of shares held at beginning of annual accounting period | (d) Number of shares held at end of annual accounting period |

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 5471 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Comprehensive Income

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 5471 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

If “Yes,” see the instructions for required statement.

If “Yes,” you are generally required to attach Form 8858 for each entity or branch (see instructions).

If “Yes,” complete lines 4b and 4c

If “Yes,” complete line 5b.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 5471 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

If “Yes,” complete lines 6b, 6c, and 6d.

If “Yes,” complete lines 6b, 6c, and 6d.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 5471 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 5471 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.