FORM 3921: EVERYTHING YOU NEED TO KNOW

WHAT IS FORM 3921?

Form 3921 is an IRS Form that reports the exercise of an employee Incentive Stock Option (ISOs). Note that ISO’s can only be issued to startup employees, not contractors.

What is the due date to file a 3921 form?

If you are a startup that has employees who exercised Incentive Stock Options (ISOs), the deadline/due date to provide Form 3921 to those employees, and file with the IRS, by Jan 31 of the following year.

For example, if your employee exercised ISOs in June 2020, the due date to provide a 2020 Form 3921 to the employee by no later than Jan 31 2021. It’s best practice to provide these forms to the employees as soon as the year closes, i.e. early in January, rather than waiting until the Jan 31 deadline.

Will the company owe any taxes on the employees exercise of ISOs and Form 3921?

No, the startup will not owe any taxes on the employees exercise of ISOs and Form 3921.

Form 3921 is an informational report, similar to 1099s, that lets the IRS know that certain individuals/entities received compensation. This makes it easier for the IRS to hold people accountable to the income that they report on their personal/entity income tax return.

WHAT INFORMATION IS NEEDED TO COMPLETE THE FORM 3921?

You will need to gather the following information in order to complete Form 3921, which you can retrieve from your HR records and Stock Leger (available from your Legal Team or Carta):

- Startup’s Legal Name

- Startup’s Address

- Startup’s FEIN (aka TIN)

- Employee’s Legal Name

- Employee’s Address

- Employee’s SSN

- Date of Option Grant

- Date of Option Exercise

- Exercise Price per Share

- FMV per Share on Exercise Date

- Number of Shares Transferred

As a startup company, we use Carta to manage our Cap Table, Stock Issuances, and Stock Exercises. I noticed that I can file 3921s within Carta but I need a TCC (Transmitter Control Code). Where is that?

In order to file your 3921s on Carta, you will first need to apply for a TCC (Transmitter Control Code) with Form 4419. There are a few things you should note here:

- Carta will fill the 3921 form, but they cannot file the form 3921 without your TCC. Your TCC code is unique to your company, much like an FEIN number. Each entity that files electronically must obtain a TCC, so for you to file yourself through Carta you would need a TCC first. Skip to step 4 to find how to avoid having to get a TCC.

- You need to submit this application by no later than Nov 1 if you wish to file Informational Returns for the tax year in question.

- The process takes 45+ days to complete. Because of these impediments, we highly recommend that you copy and transfer the 3921 information over to Track1099, where you will be able to file the same day. Copy and pasting each form over takes less than 30 seconds, as there is limited information.

- If you have less than one hundred 3921’s to file, we highly recommend skipping the TCC application and filing on Track1099. Kruze files 3921 forms for our clients through Track1099, and we do not need to get an TCC to do this, since we have a TCC that allows us to file for multiple companies.

As a startup employee, what do I need to do with Form 3921?

As a startup employee, you will need to file Form 3921 with you personal taxes on Form 1040, which is due by Apr 15th of every year and can be extended to Oct 15th of every year. You can either input this information into TurboTax (and most other online tax software) yourself, or give the form to your preferred tax provider.

AS A STARTUP EMPLOYEE, WILL I OWE TAXES ON FORM 3921?

As a startup employee who exercises an Incentive Stock Option (ISOs), you wont pay taxes until you sell the stock. This differs from NonQualified Stock Options (NQSOs), where the exerciser is taxed upon the exercise of the NQSO.

Where can I learn more about the exercise of ISOs and NQSOs, and how the startup taxes work?

You can learn more about ISO (Incentive Stock Option), or an NQSO (Non-Qualified Stock Option) here. As always, if you have any questions on this, feel free to contact Kruze. We have a dedicated tax team willing and happy to help you out.

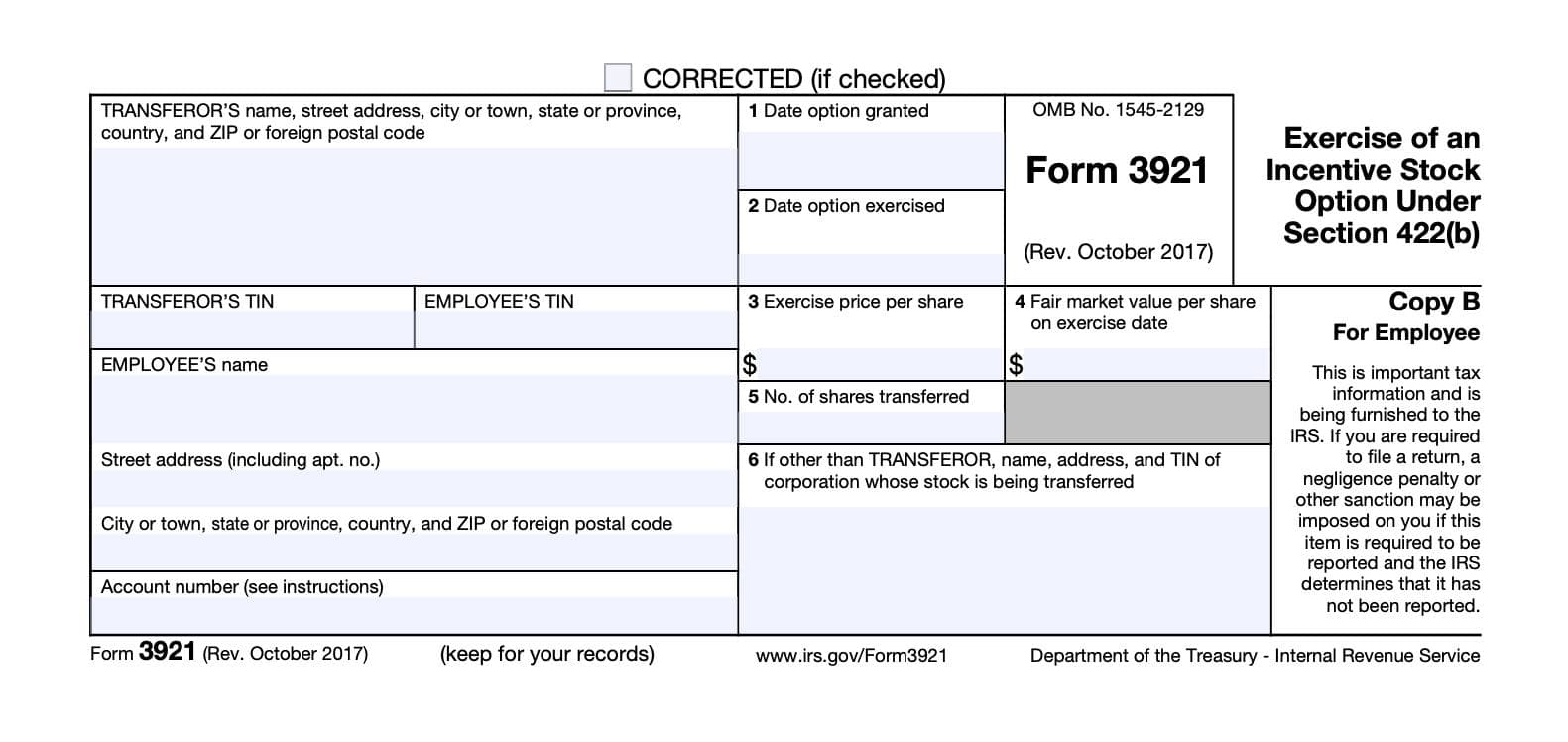

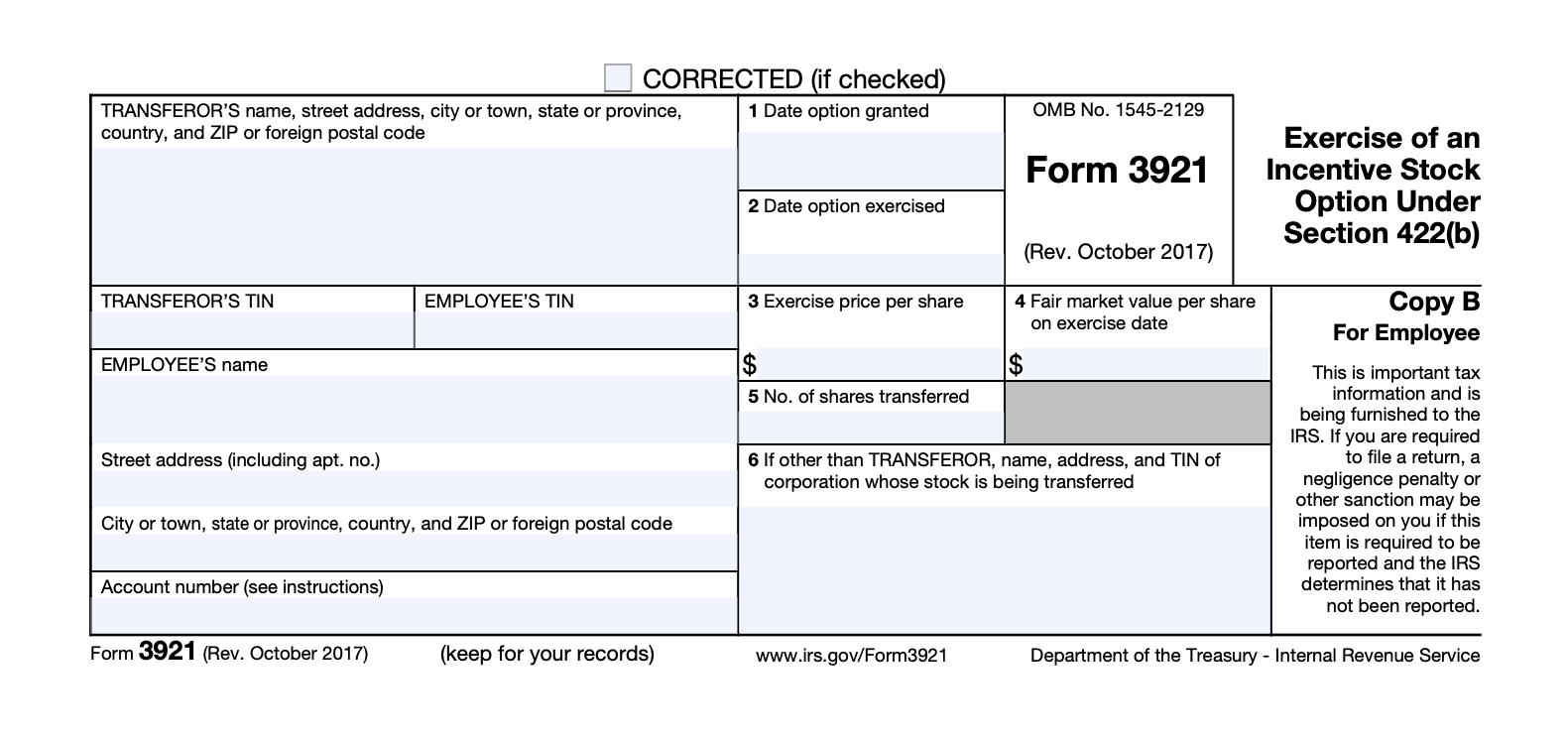

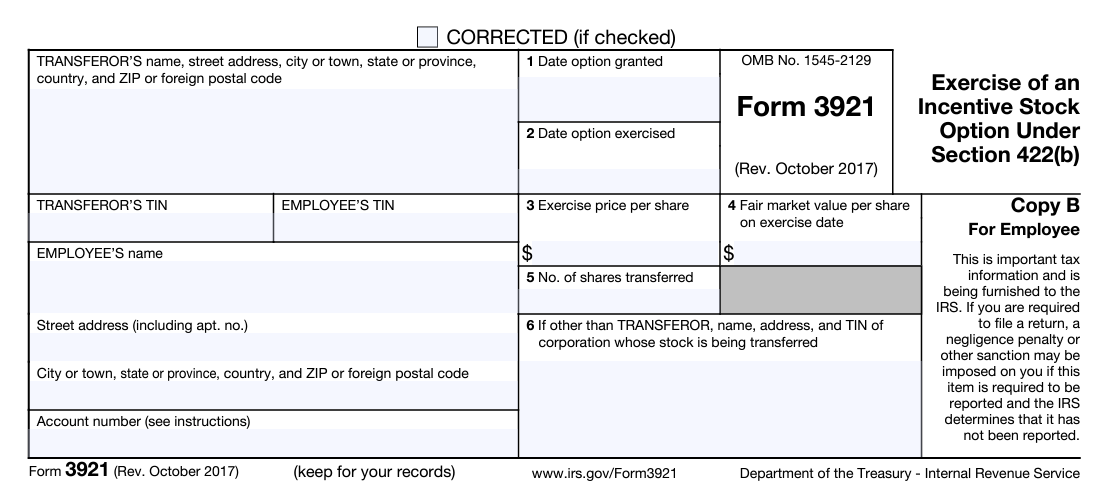

Form 3921: Form A vs Form B vs Form C

There are 3 copies of this form produced. Form A is filed with the IRS; Form B is provided to the employee; Form C is kept for internal records (i.e. your startup should keep it on file with your other tax records).

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

To order official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order.

Information returns may also be filed electronically using the IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE) or the IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

How To Report Form 3921 As An Employee

If you received Form 3921, it’s because your employer transferred company stock to you through an incentive stock option (ISO). Keep this form to calculate any gain or loss you must report on your tax return when you eventually sell or dispose of the stock.

Form 3921 is crucial for tracking the fair market value and your potential alternative minimum taxable income (AMTI), which might apply when you exercise an ISO. For detailed guidance, refer to IRS Publication 525, which explains reporting requirements related to incentive stock options.

When tax time comes, include Form 3921 with your Form 1040, typically due by April 15, though you can extend this deadline to October 15 if needed.

Keep in mind that if you’ve exercised an ISO, you generally won’t owe taxes on the stock itself until you choose to sell it; this form simply helps track your potential tax liability down the road.

Guide To Filling Out Form 3921

Here are high-level instructions on how to fill out Form 3921.

Step 1: Gather Important Information

To complete Form 3921, companies need to gather some important information about both the company and its employees, along with specifics about exercised incentive stock options (ISOs). You’ll also need optional account numbers if employees have multiple accounts. Filing can be done electronically through the IRS FIRE (Filing Information Returns Electronically) system or by mail with IRS-approved paper.

To get started, gather the essentials: a list of employees who exercised ISOs in the past year, your company’s Transmitter Control Code (TCC), and each employee’s Tax ID number. Gathering everything ahead of time makes the filing process much smoother.

Step 2: Fill In Required Fields

To complete Form 3921 accurately, make sure you enter all essential details about the employee, the exercise of the option, and the stock transfer.

Here’s how to fill out each box on Form 3921:

- Transferor’s Name, Address, and TIN: Enter the name, address, and Taxpayer Identification Number (TIN) of the transferor in the upper left-hand corner of the Form.

- Employee’s Name, Address, and TIN: Enter the name, address, and Taxpayer Identification Number (TIN) of the employee receiving the shares due to their option exercise.

- Account Number: If the employee has multiple accounts requiring multiple Form 3921 filings, enter the specific account number here. The IRS also recommends providing an account number even if there’s only one form.

- Box 1. Date Option Granted: Input the date when the stock option was originally granted to the employee.

- Box 2. Date Option Exercised: Enter the date the employee exercised their stock option.

- Box 3. Exercise Price Per Share: Record the exercise price per share of stock at the time the option was exercised.

- Box 4. Fair Market Value Per Share on Exercise Date: List the fair market value (FMV) of each share on the exercise date.

- Box 5. Number of Shares Transferred: Enter the total number of shares transferred as a result of the option exercise.

- Box 6. If Other Than Transferor, Name, Address, and TIN of Corporation Whose Stock Is Being Transferred: If the corporation issuing the stock is different from the one listed as the transferor, provide the name, address, and TIN of the corporation whose stock is being transferred here.

Step 3: File Copy A With The IRS

You must submit Copy A of Form 3921 to the IRS, either via mail or electronically.

Step 4: Send Copy B To The Employee

Provide Copy B to the employee who exercised their options.

Step 5: Retain Copy C For Your Records

Make sure and keep Copy C of Form 3921 for your company’s records.

$

$

For Internal Revenue Service Center

File with Form 1096. For Privacy Act and Paperwork Reduction Act Notice, see the current version of the General Instructions for Certain Information Returns.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 3921 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

$

$

This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be reported and the IRS determines that it has not been reported.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 3921 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Instructions for Employee

You have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive stock option (ISO). You must recognize (report) gain or loss on your tax return for the year in which you sell or otherwise dispose of the stock. Keep this form and use it to figure the gain or loss. For more information, see Pub. 525, Taxable and Nontaxable Income.

When you exercise an ISO, you may have to include in alternative minimum taxable income a portion of the fair market value of the stock acquired through the exercise of the option. For more information, see Form 6251, Alternative Minimum Tax—Individuals, and its instructions.

Employee’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your social security number (SSN), individual taxpayer identification number (ITIN), or adoption taxpayer identification number (ATIN). However, the employer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number your employer or transfer agent assigned to distinguish your account.

Box 1. Shows the date the option to purchase the stock was granted to you.

Box 2. Shows the date you exercised the option to purchase the stock.

Box 3. Shows the exercise price per share of stock.

Box 4. Shows the fair market value (FMV) of a share of stock on the date the option was exercised.

Box 5. Shows the number of shares of stock transferred to you pursuant to the exercise of the option.

Box 6. Shows the name, address, and TIN of the corporation whose stock is being transferred (if other than the corporation shown in TRANSFEROR boxes in the upper left corner of the form).

Future developments. For the latest information about developments related to Form 3921 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form3921.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 3921 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

$

$

For Corporation

This copy should be retained by the corporation whose stock has been transferred under Section 422(b).

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 3921 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

$

$

For Transferor

For Privacy Act and Paperwork Reduction Act Notice, see the current version of the General Instructions for Certain Information Returns.

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 3921 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.

Instructions for Transferor

To complete Form 3921, use:

• the current General Instructions for Certain Information Returns, and• the current Instructions for Forms 3921 and 3922. To order these instructions and additional forms, go to www.irs.gov/Form3921.

Caution: Because paper forms are scanned during processing, you cannot file Forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the IRS website.

Due dates. Furnish Copy B of this form to the employee by January 31 of the year following the year of exercise of the ISO.

Furnish Copy C of this form to the corporation whose stock is being transferred by January 31 of the year following the year of exercise of the ISO.

File Copy A of this form with the IRS by February 28 of the year following the year of exercise of the ISO. If you file electronically, the due date is March 31 of the year following the year of exercise of the ISO. To file electronically, you must have software that generates a file according to the specifications in Pub. 1220. The IRS does not provide a fill-in form option for Copy A.

Need help? If you have questions about reporting on Form 3921, call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 (not toll free). Persons with a hearing or speech disability with access to TTY/TDD equipment can call 304-579-4827 (not toll free).

Warning: This information is for informational purposes only and should not be used for official tax matters. Use the official Form 3921 and instructions, generally found at: https://www.irs.gov/forms-instructions. Rely on this information at your own risk. Visit https://www.irs.gov/forms-instructions for official IRS information. Consult with a tax professional.