This is a recent newsletter we sent to clients regarding funding sources for VC funded companies during the COVID crisis. It is current as of the morning of March 25; the legislation is still being worked on so it will likely quickly be out of date. We’ll keep our clients up to date via email. We’ve published an update blog post with information on the CARES Act and startups that we are keeping as up to date as we can at the moment.

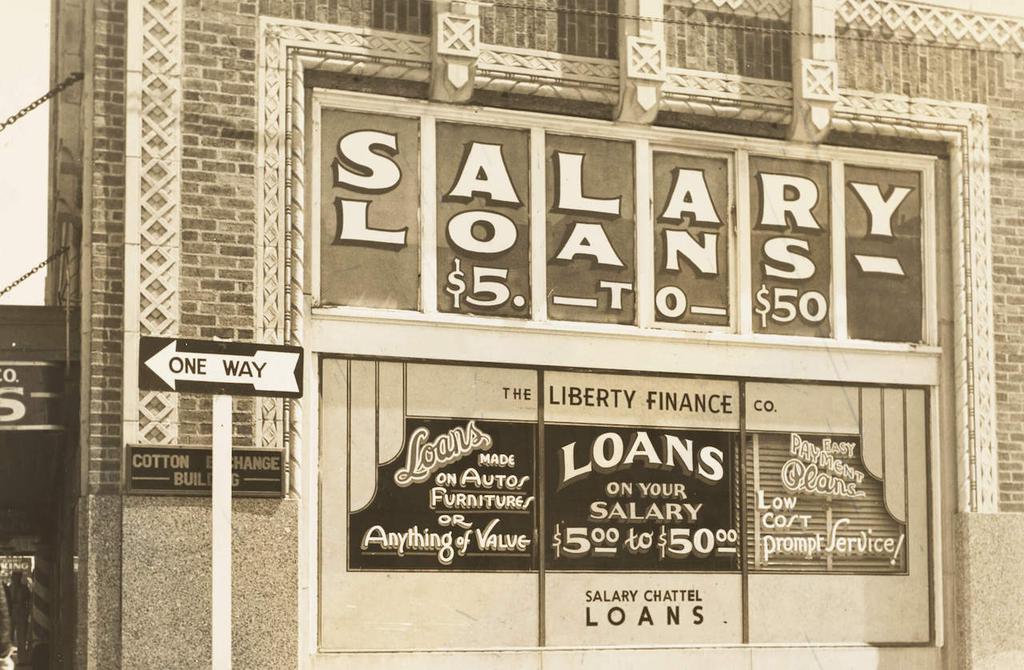

Congress is working on legislation to help businesses survive the COVID-19 crisis. Traditionally, SBA loans would not be a fit for venture-backed startups because of personal guarantees requirements and majority ownership issues.

HOWEVER, the NVCA (National Venture Capital Association) is aggressively lobbying Congress to get the personal guarantee taken out and create an exception for the ownership requirements. If the NVCA is successful, startups will have access to the SBA crisis loans which may include one to two months of salary reimbursement for employees.

There are a ton of “what if’s” here as the legislation is in flux. If this legislation passes, then startups are effectively getting a capital injection equal to one to two months of employee salaries. These loans may also be forgiven if the company keeps payroll constant during the crisis. It’s unclear what the headcount continuity thresholds will be required by the legislation. We’ll keep you updated as soon as we learn. We’re bringing this up now before the Legislation is complete so that you can think through any headcount reductions you are planning. Loans that will be forgiven is an attractive source of supplemental financing that startups should try to use.

When the legislation passes, the first thing Founders should check on is the personal guarantee requirement. Personally guaranteeing these loans could ruin a founder’s financial health.

We’re staying plugged in and will let you know as we hear more.

What are Alternative Funding Sources for Startups right now?

- The best ones are your customers. Doing upfront deals where you sign customers for a year, but give a discount for paying upfront is fantastic. That is your cheapest form of financing! Several of our clients are working on large, upfront deals with some of their largest customers. Of course, they are offering large discounts - but still, getting cash in the door fast is a solid way to bolster your balance sheet.

- Bridge Financings from Existing Investors - most startups fund on 18 - 24 month cash cycles. You raise money, you spend it over 18-24 months. Before you’re out, you go back showing your metrics and raise the next round. When a crisis like this hits, VC’s often do supplemental investments into their companies to get them to the other side of the crisis. It’s not fun for VC’s, but they build their reputation on supporting their companies. The terms are usually expensive. But your existing investors are a great place to start looking for more capital. We’ve helped clients like that recently; if you have strong investors, this could be a great move.

- Traditional Venture Debt - these lenders only lend to VC backed startups. They do loans with interest + equity warrants attached. They’re being flooded with requests now and triaging their own portfolios, but they are open for business. Venture Debt is a great alternative for startups doing well that just need a little extra runway. However, if your company is struggling, venture debt can be more problematic than helpful. To get smart on Venture Debt, listen to leading lenders and their Kruze podcasts - WTI, Triplepoint Podcast, Bridge Bank Podcast, Orix Podcast, and PacWest Podcast, etc.

- Revenue Loans like Lighter Capital where they advance a large sum of capital, and it is repaid by taking out a few % of your monthly revenue. The total interest rates are high, but it’s usually cheaper than equity. Listen to our podcast with Lighter Capital to learn about revenue-based financing and see if it makes sense for your startup.

- If…and this is huge if. The Founder owns a huge % of the company and wants to grant a personal guarantee on a loan, the SBA is a good place. Note, most VC backed startups lose a lot of money. So Founders should not give personal guarantees. But if your company is cash flow breakeven and you own a lot of it, the personal guarantee could work for you. Again, the legislation isn’t 100% through Congress, so we don’t know if the loans will be forgiven if payroll is constant, or if there will be a guarantee. But this is something we’ll keep watch over and will update our clients once the answer is definitive.

- Take advantage of government programs that can reduce your payroll taxes:

-

R&D tax credit - this can save you money this year on your payroll taxes, up to $250,000 a year. We can help you with this - we are already on track to reduce our clients’ burn through this program by $5 million this year. See if we can help you using this online calculator.

-

Payroll tax credit for sick workers - the government is offering up to ~$500 a day in payroll tax credits to help compensate employers who pay sick employees due to this crisis; read more here. The situation is fluid and the rules are not yet fully written, so we’ll stay abreast and advise our clients accordingly.

Need help with reforecasting, understanding your numbers or taking advantage of the government credits? Reach out to us now!